Move forward, with an online mortgage

Get the mortgage you need, easily online. No paperwork. It’s that simple

Get the mortgage you need, easily online. No paperwork. It’s that simple

Buying a house in the UK? Explore our range of mortgage products

Introducing Molo Home: FlexLife mortgages

A fixed long-term loan where payments never change

Here’s what you need to do to get your mortgage in minutes

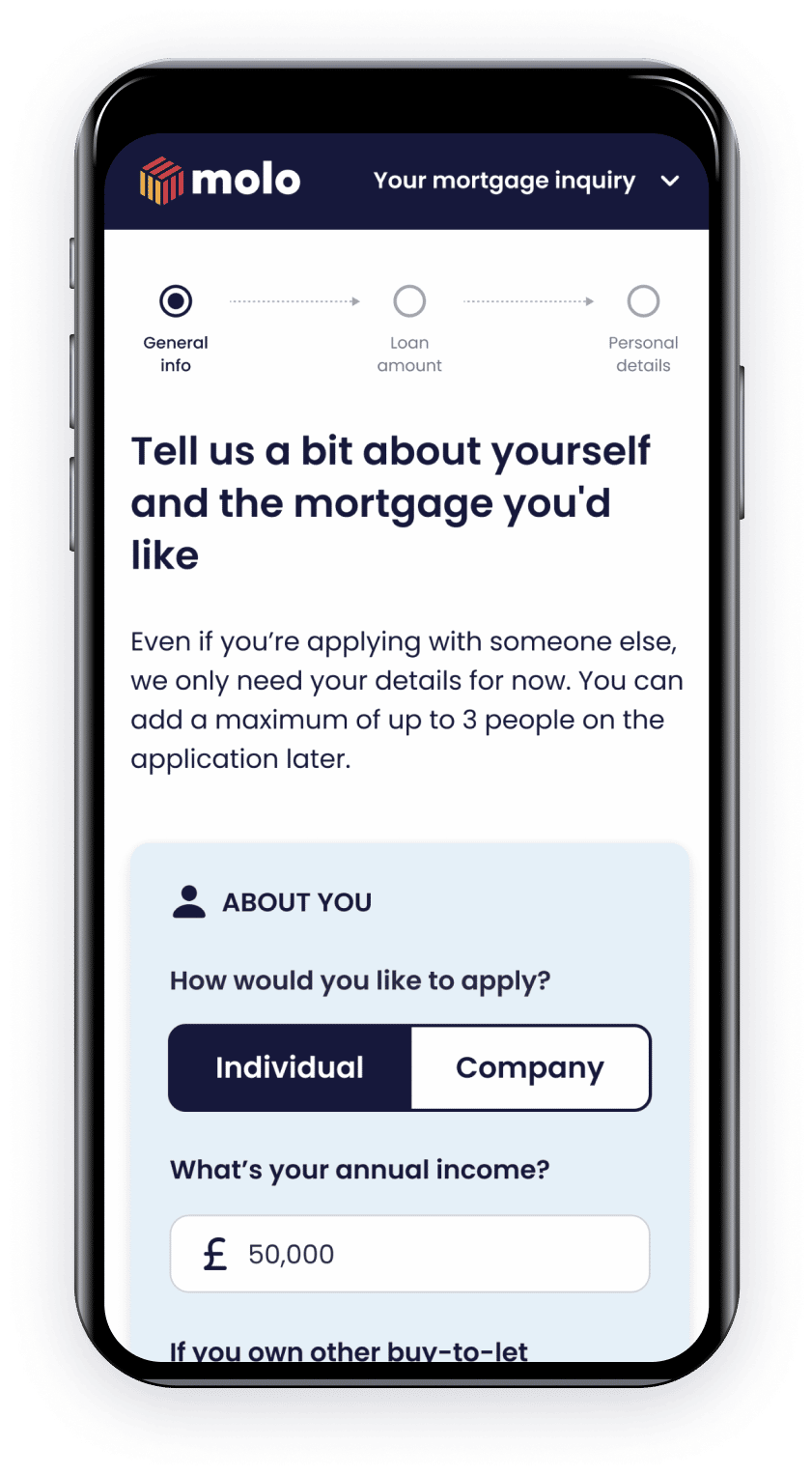

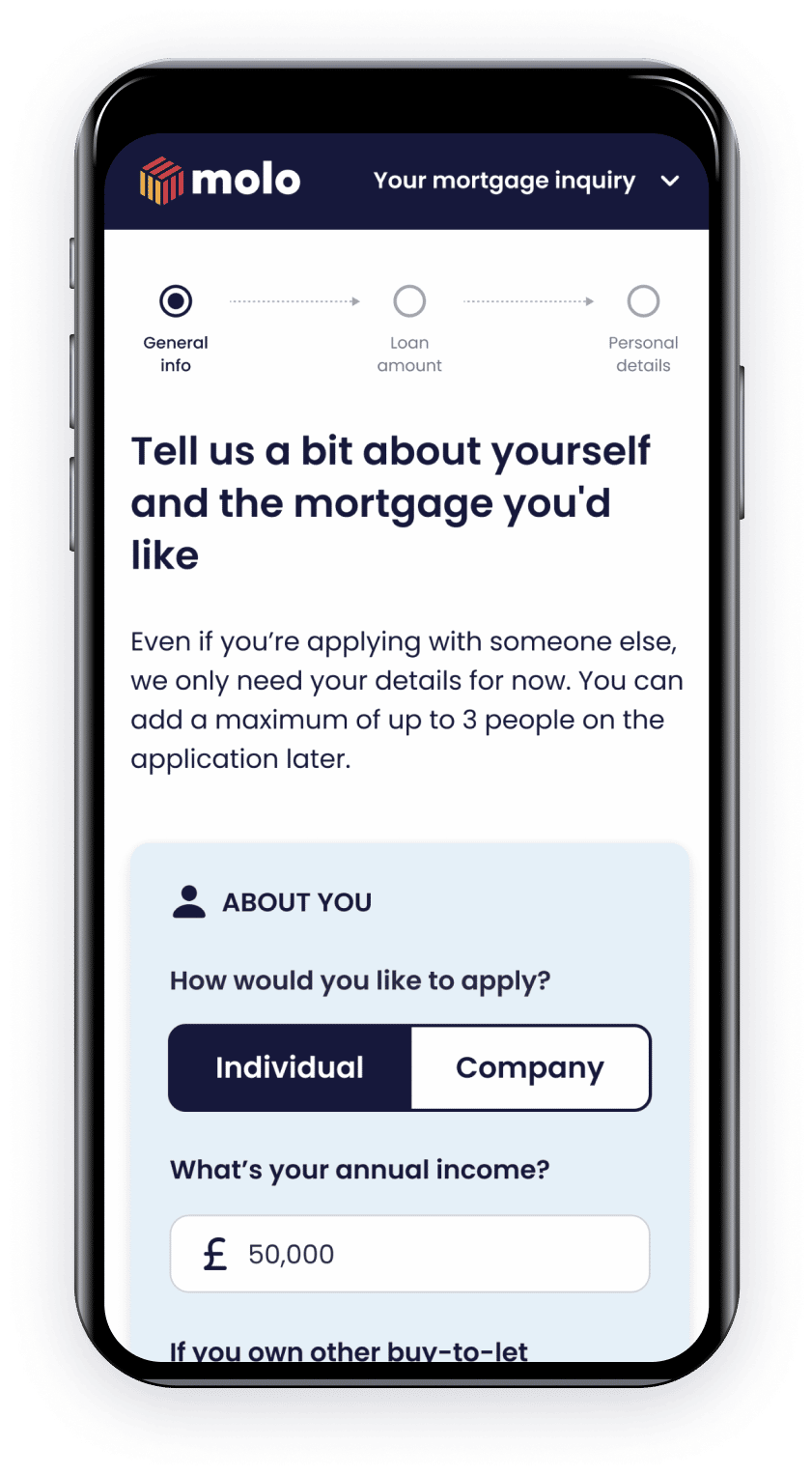

Check your eligibility

Check your eligibility

Answer a few questions about you and what you think you'd like to borrow

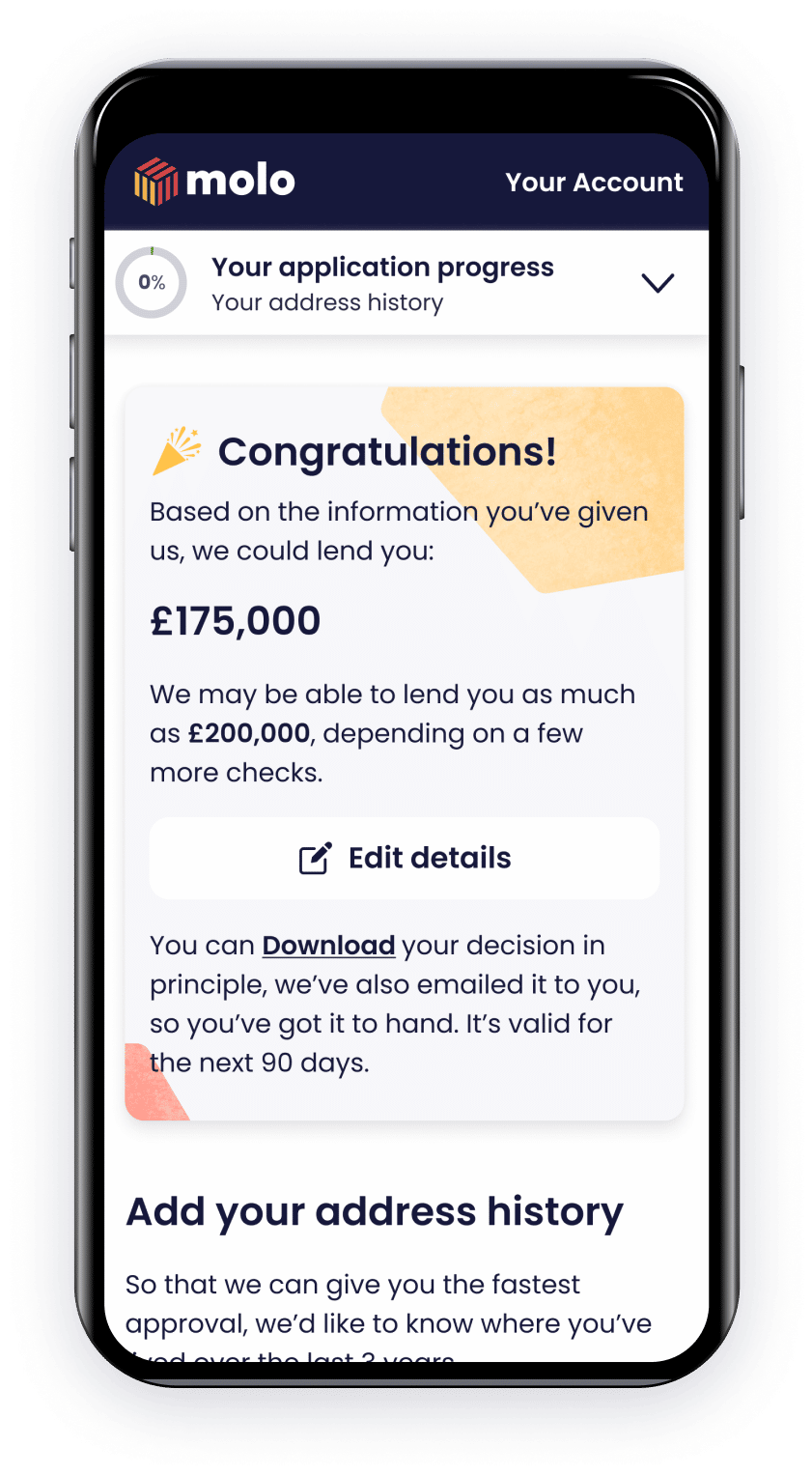

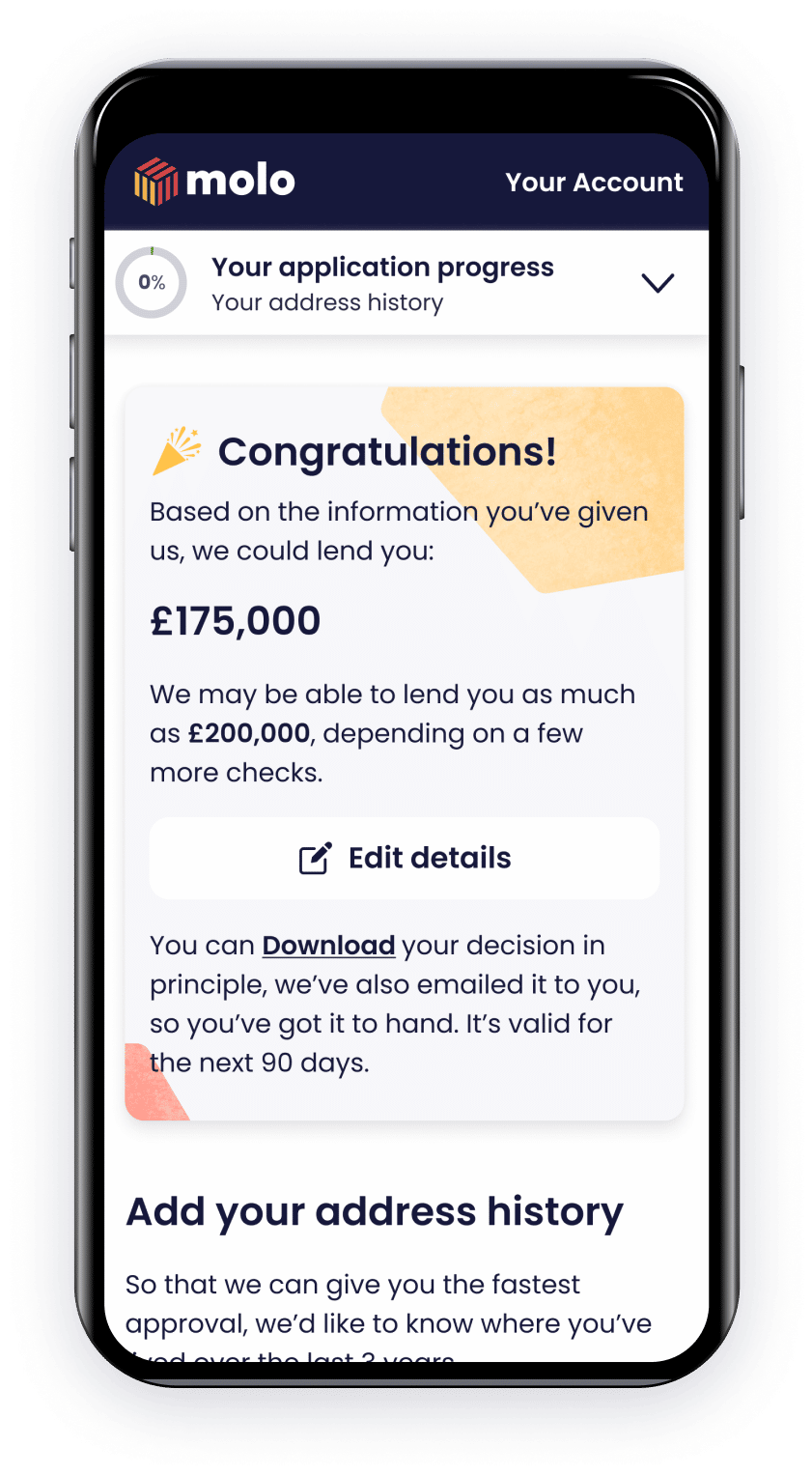

Mortgage in Principle

Mortgage in Principle

We'll let you know whether we can lend to you and how much you can borrow

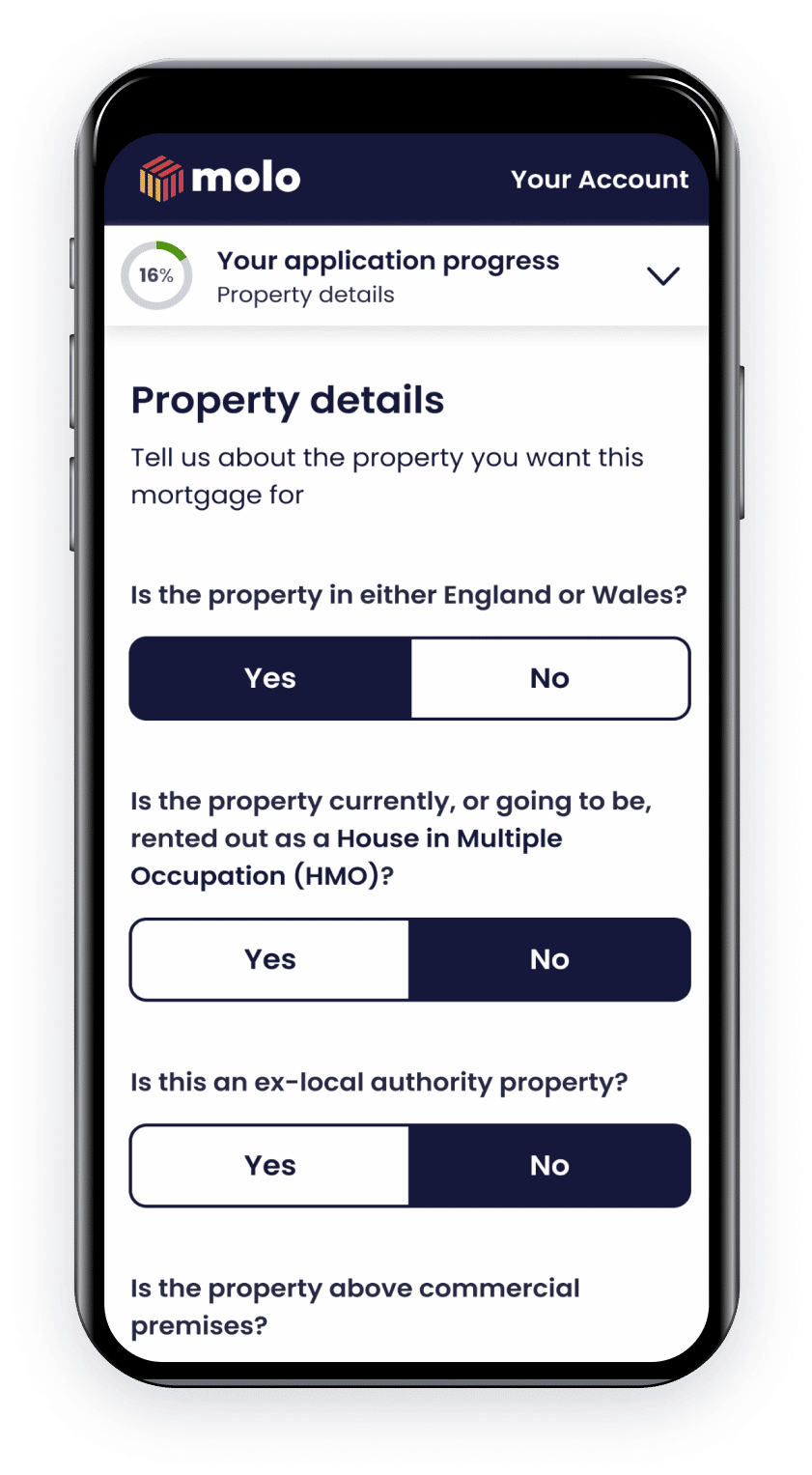

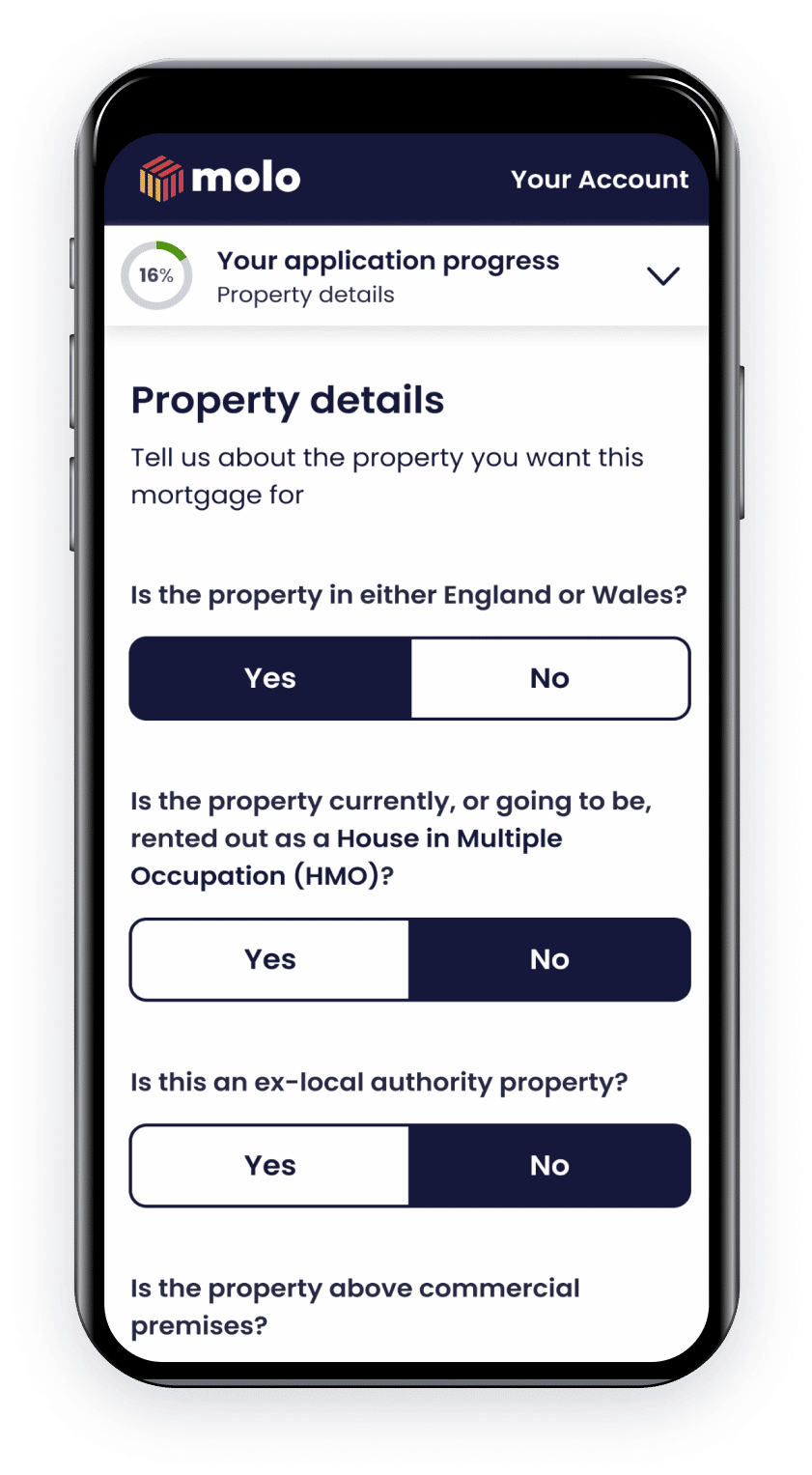

Property check

Property check

Tell us a bit about the property you'd like to buy

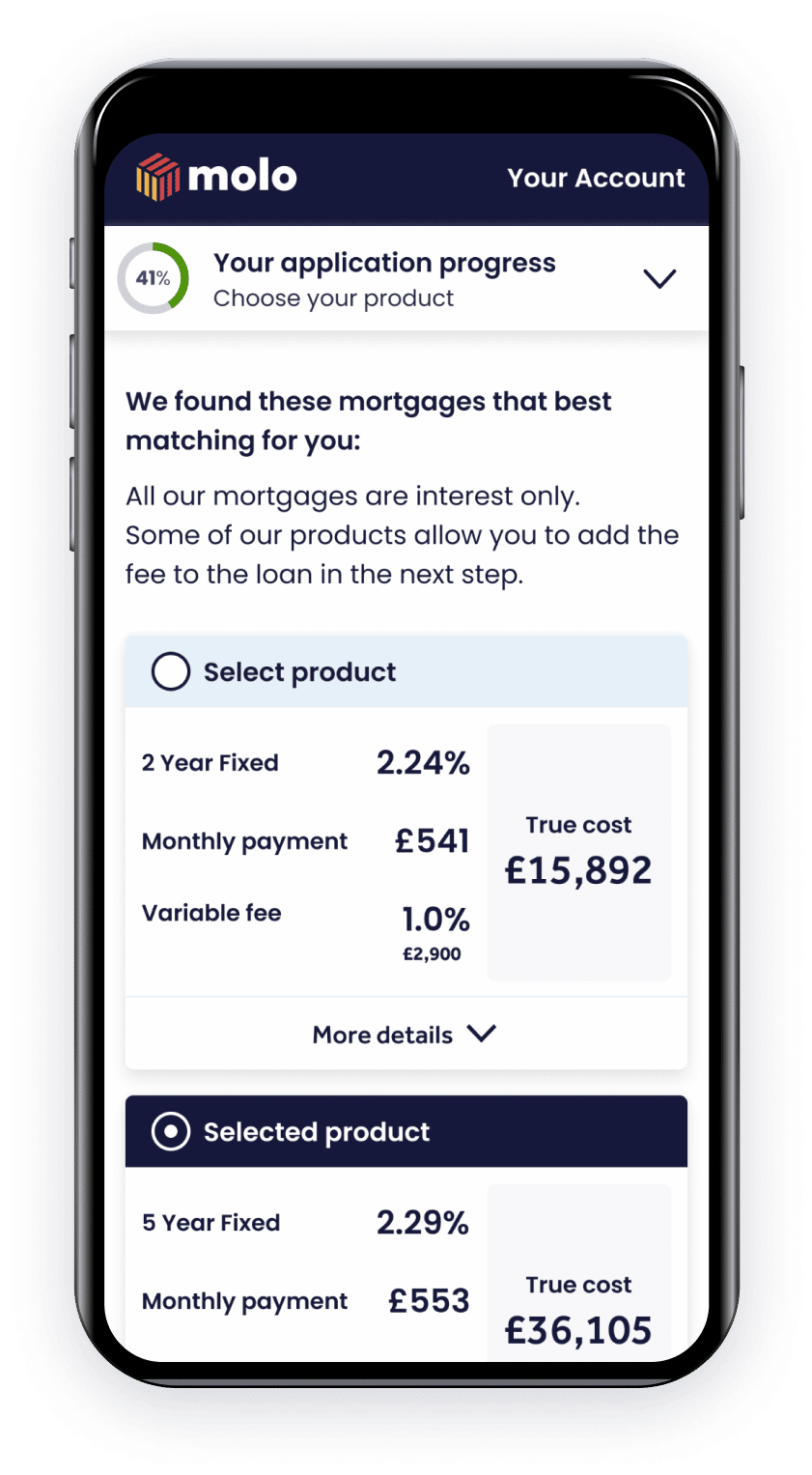

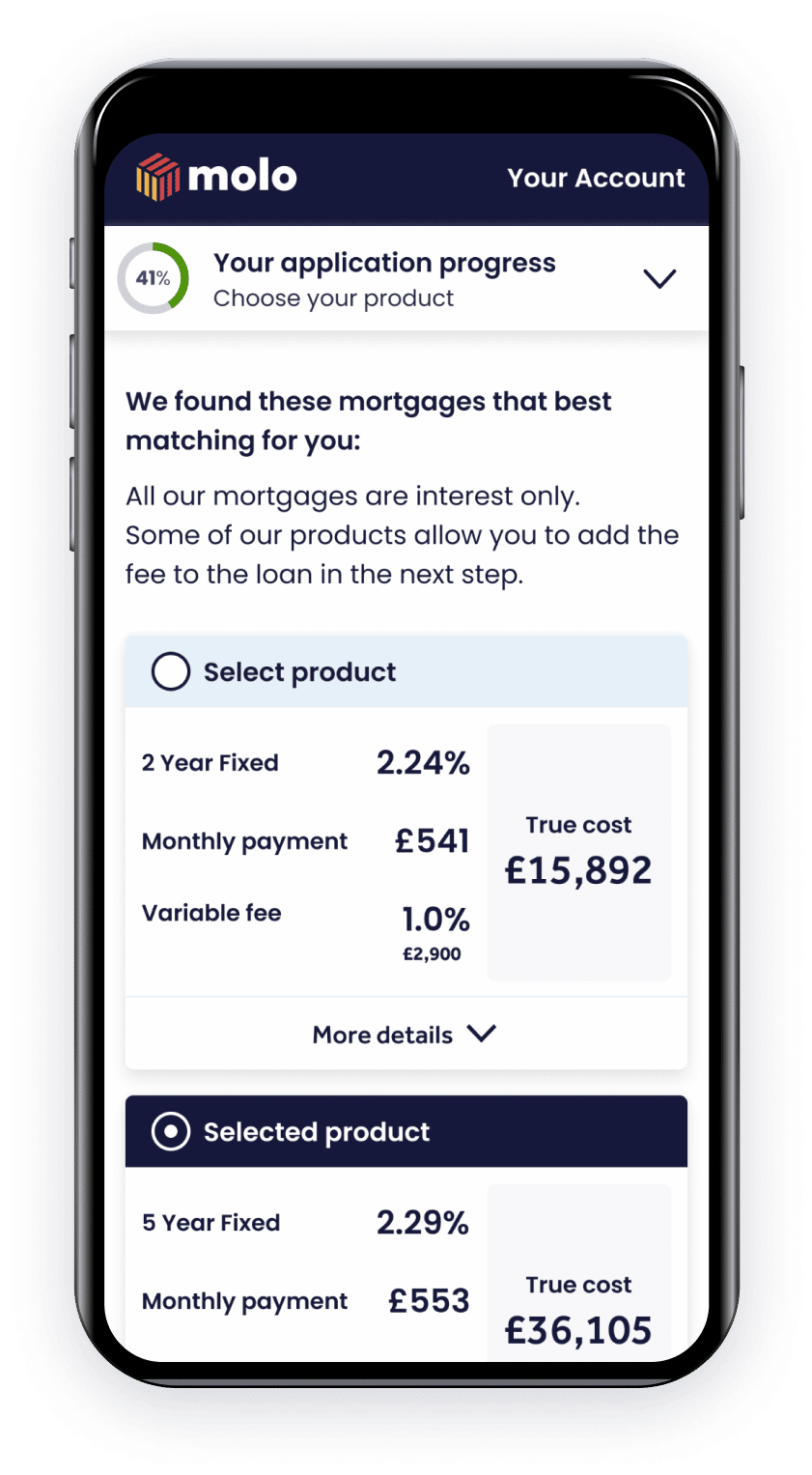

Choose your mortgage

Choose your mortgage

Select the mortgage that's right for you

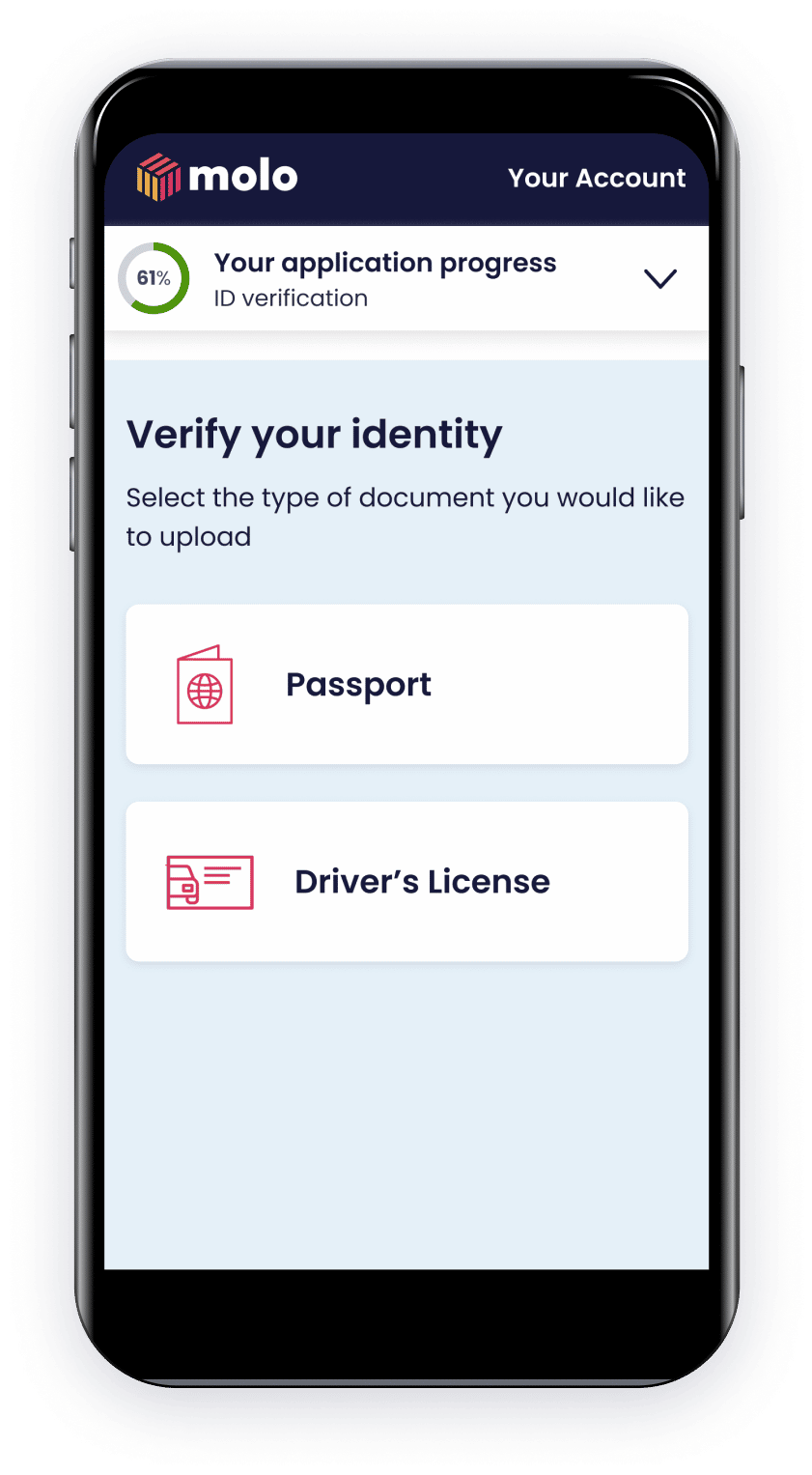

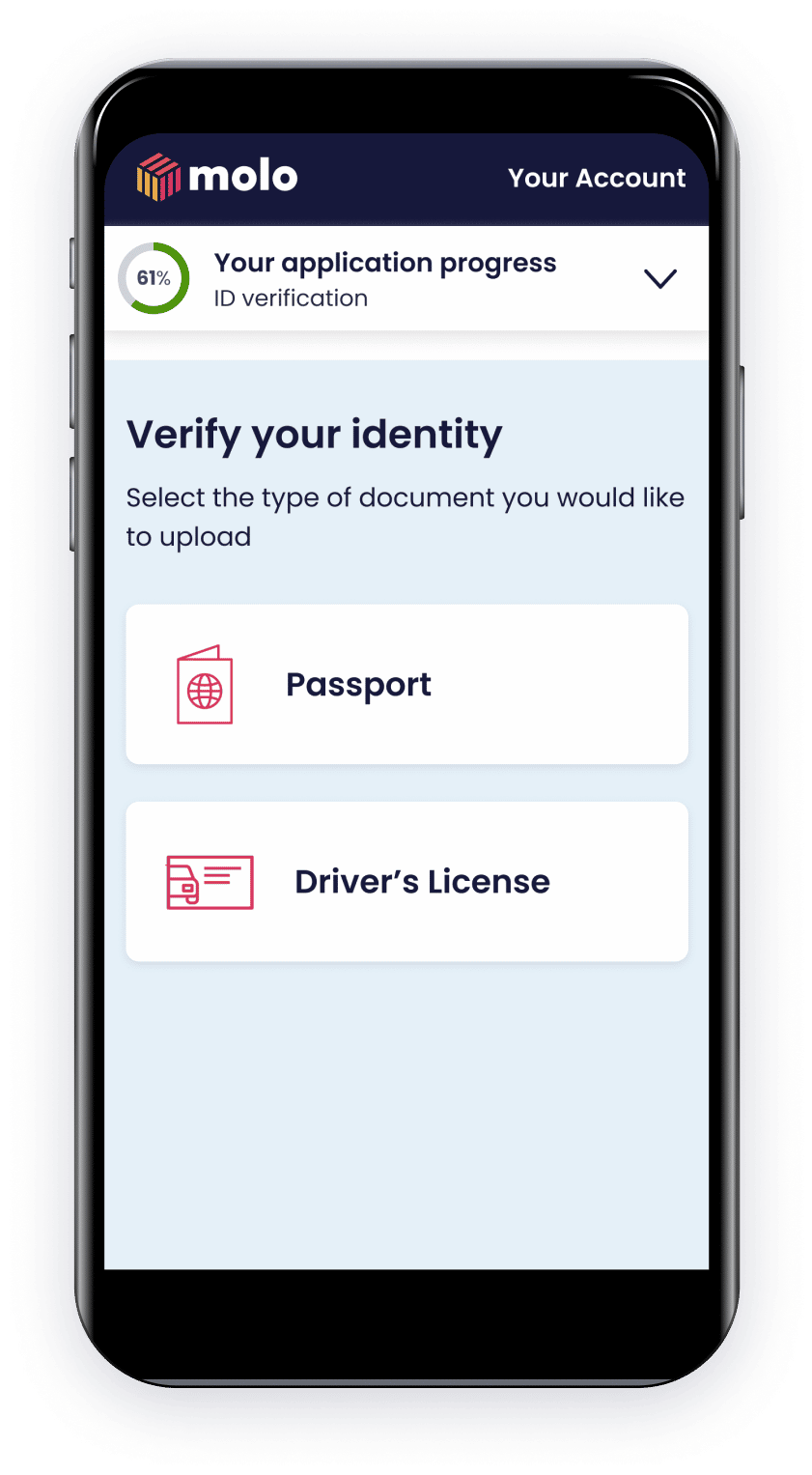

ID verification

ID verification

Upload your ID and take a selfie so we can check you're you

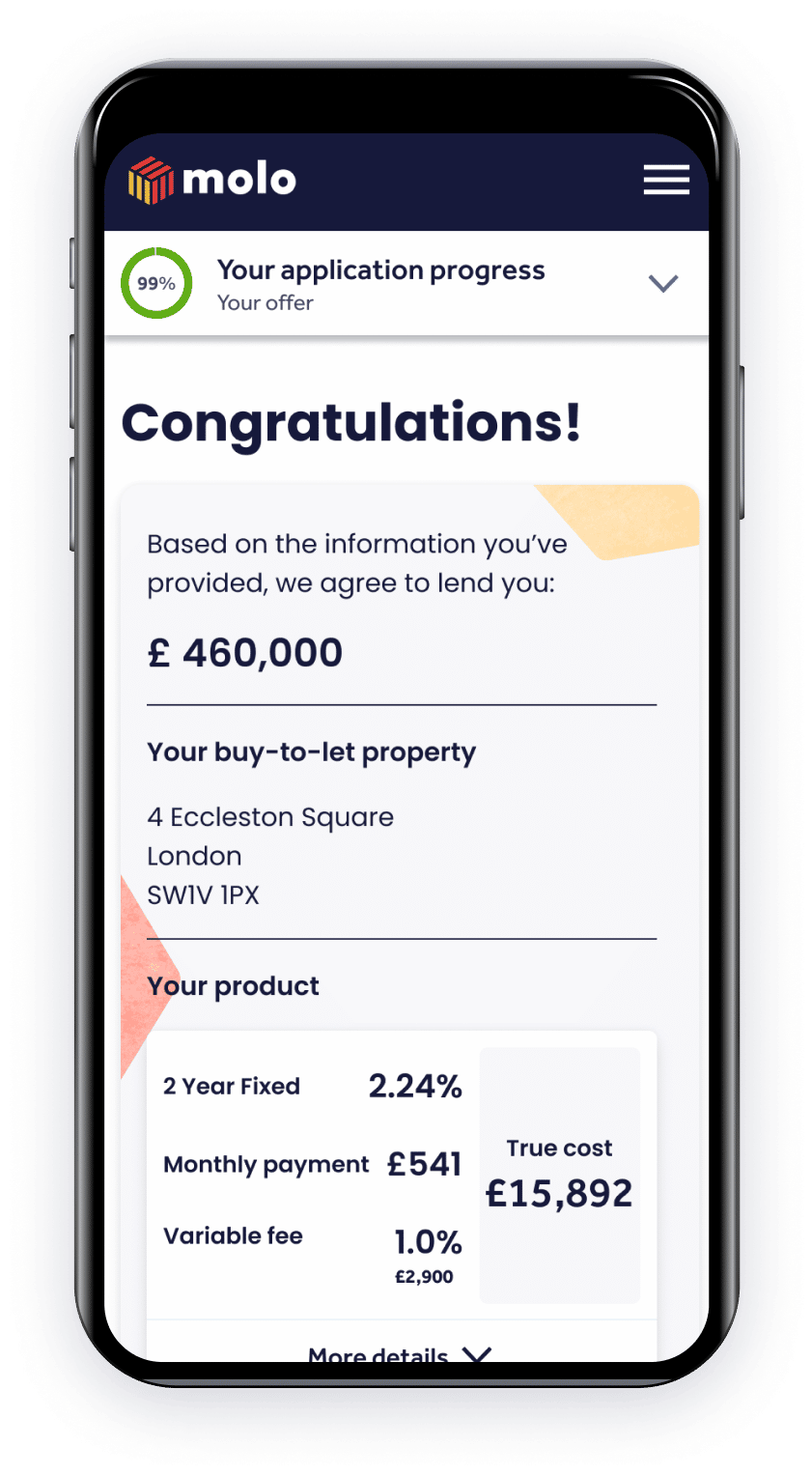

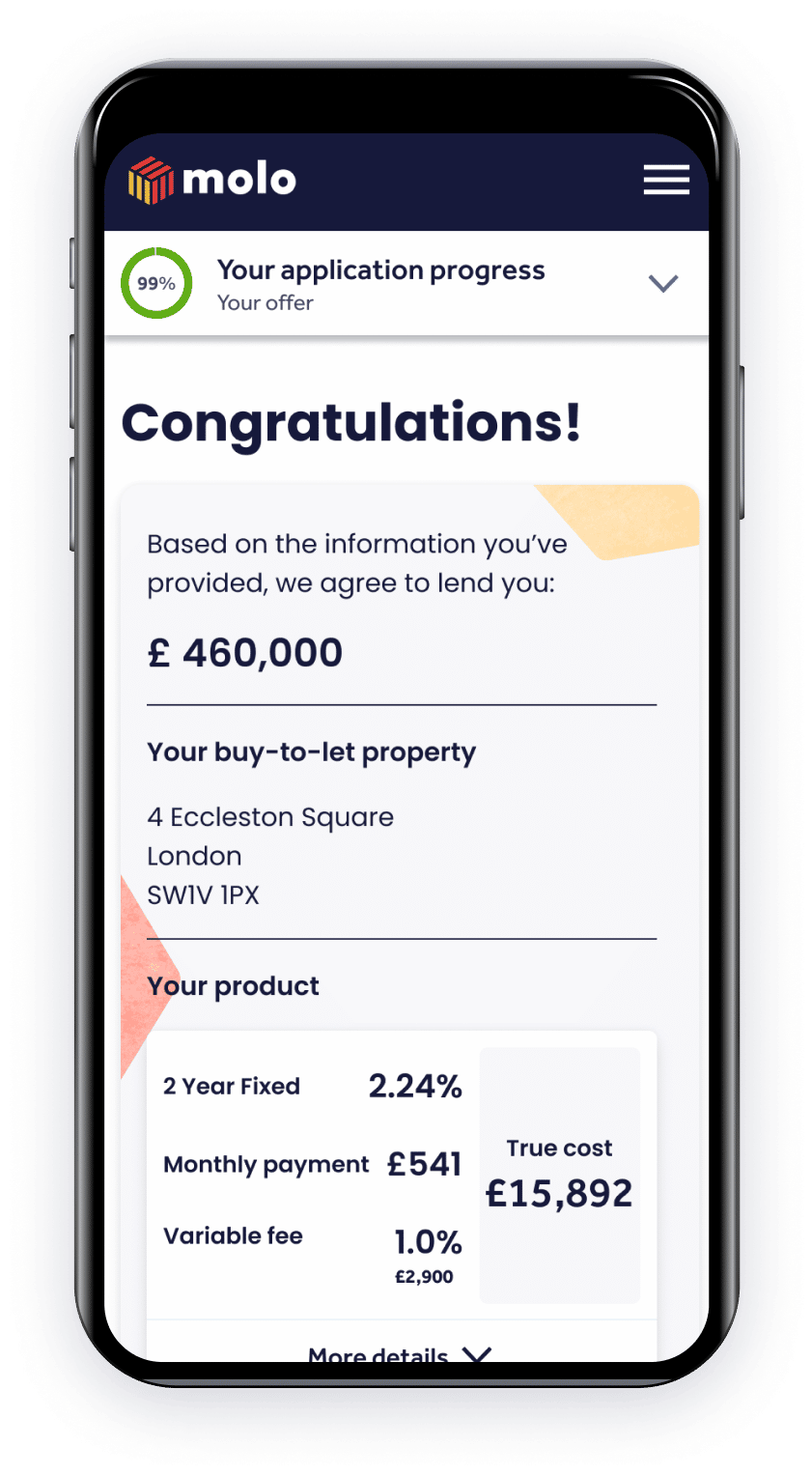

Mortgage offer

Mortgage offer

If you and your chosen property meet our lending criteria, we'll agree your mortgage offer

Check your eligibility

Answer a few questions about you and what you think you'd like to borrow

Mortgage in Principle

We'll let you know whether we can lend to you and how much you can borrow

Property check

Tell us a bit about the property you'd like to buy

Choose your mortgage

Select the mortgage that's right for you

ID verification

Upload your ID and take a selfie so we can check you're you

Mortgage offer

If you and your chosen property meet our lending criteria, we'll agree your mortgage offer

Your experience is at the heart of what we do.

mortgage applications

Submitted in our digital platform.

online access

Check in on your

application any time.

Mortgage in Principle

See what you could

borrow, fast & for free.

We make it easier for people to buy a house with an online mortgage loan

" Have been dealing with Molo for a while now and they're a great lender with an easy to use system. Would definitely recommend giving them a go "

United Kingdom

A Mortgage in Principle is a document that a lender can provide to show how much they’d be prepared to lend to you, in principle. A Mortgage in Principle isn’t a formal mortgage offer, and the final lending amount could be different from the amount shown.

You can get an online Mortgage in Principle from Molo, which you can then show to estate agents to prove how much you could afford to spend on a property.

The process of buying a house usually takes several months, and can broadly be broken down into the following stages:

Getting a mortgage needn’t be complicated. With digital lenders you can see our mortgage rates and apply easily online.

You’ll first need to decide how much you need to borrow, then which type of mortgage you need (eg. fixed or variable rate).

You’ll need to provide some information about your finances and your property. This will form your application, which your lender will review. If approved, the mortgage can begin on your required date.

To get a mortgage, you’ll need to demonstrate you have a history of paying your debts. Credit scoring agencies store this information and share it with lenders when you apply for a mortgage.

If you have a good credit history, you’ll be given a higher credit score. The higher your credit score, the better your chance will be of getting the mortgage deal you want.

Credit scores for mortgages are important. You can check your score online using one of the credit scoring agencies, and take steps to improve it if necessary.