This website is for customer use only. If you’re an intermediary, please go to our intermediary site here.

Our remortgage deals

Remortgage your property, easily online

Remortgaging to Molo

Switch to the online lender made for the 21st century

Apply easily online

There’s no paperwork or appointments to worry about.

Faster decisions

See if you’re application’s approved in as little as 24 hours.

Access 24/7 support

Our team’s on hand to help, whenever you need them.

Enjoy top level service

We’re proud of our Excellent Trustpilot rating.

How it works

Here’s what you need to do to get your mortgage in minutes

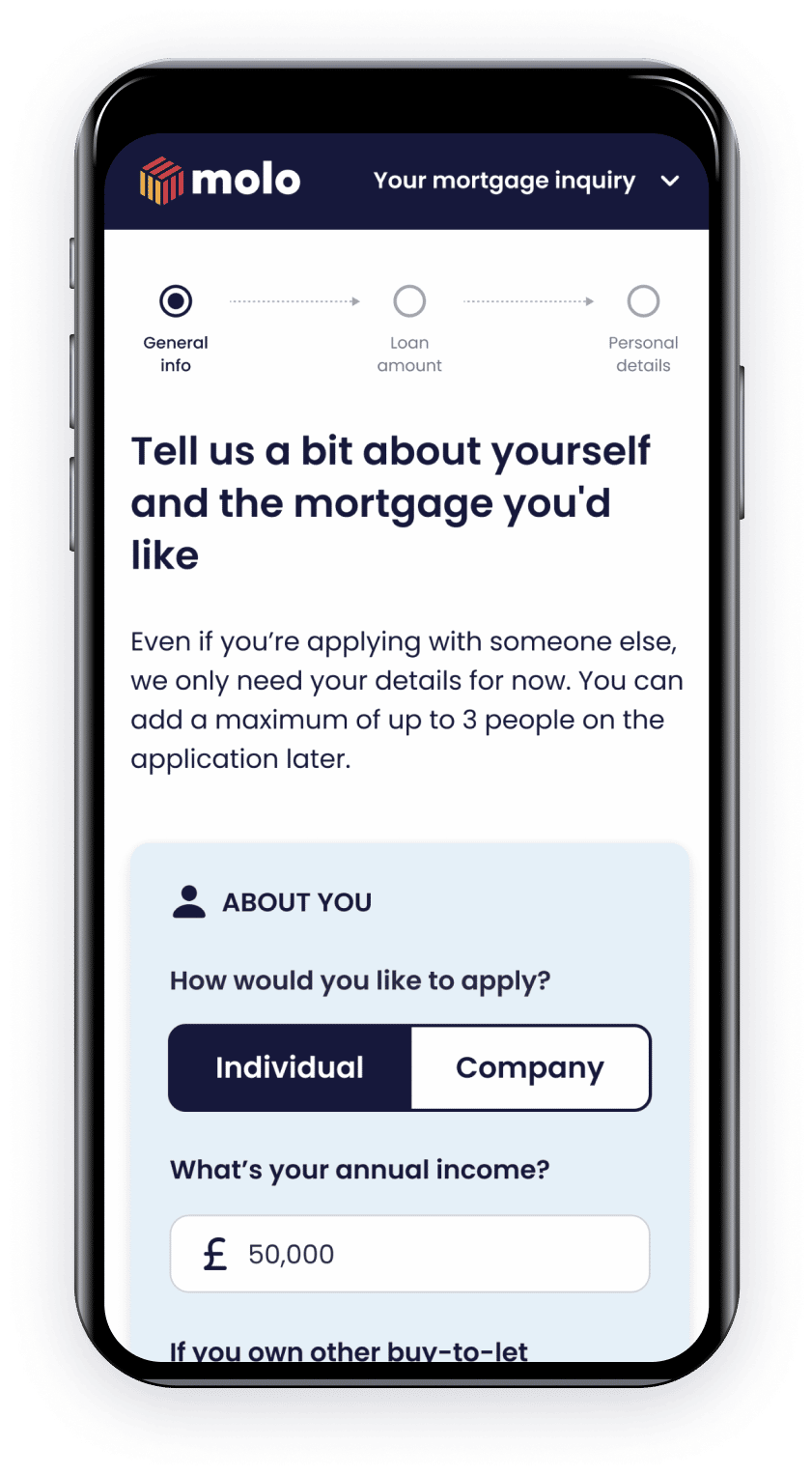

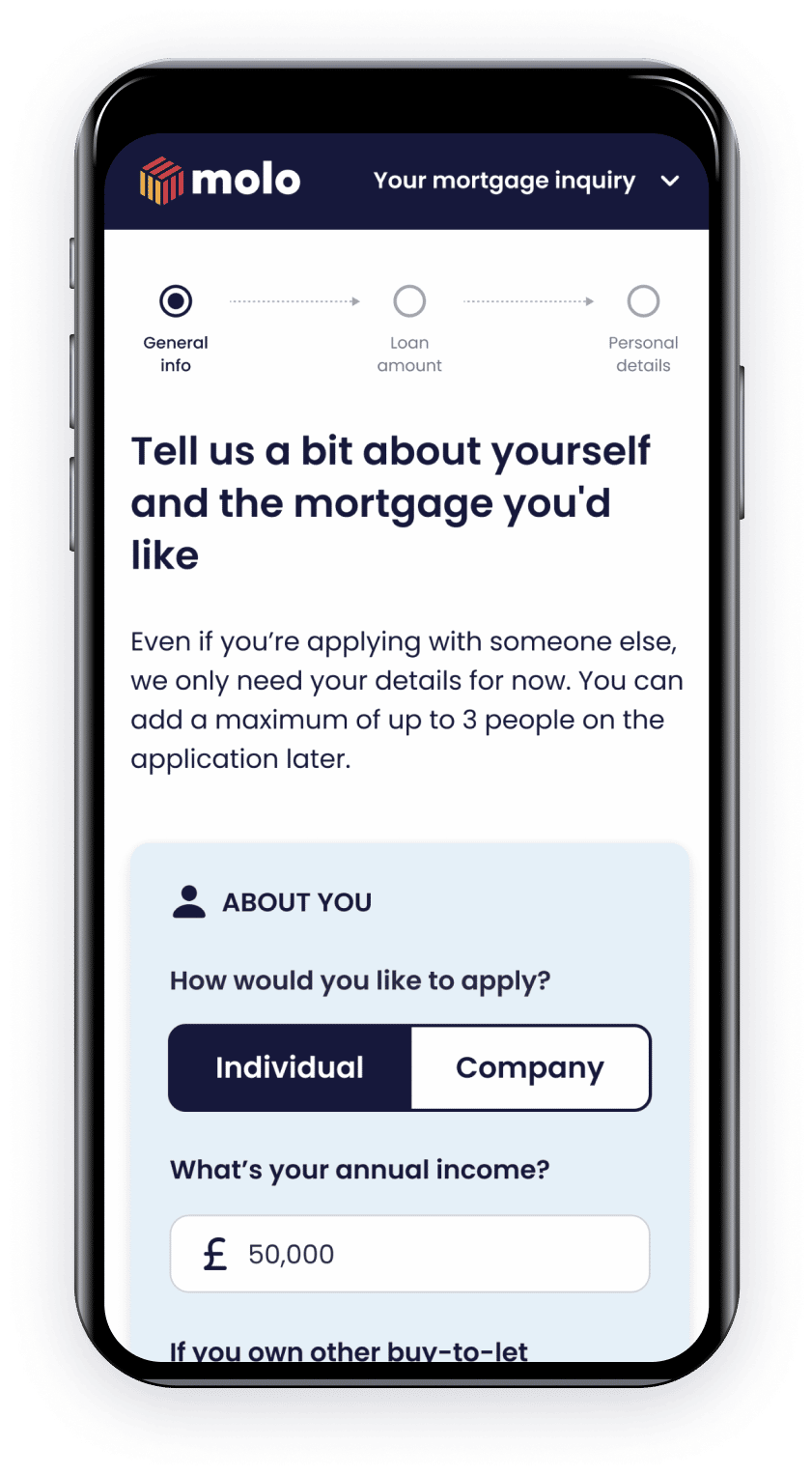

Check your eligibility

Check your eligibility

Answer a few questions about you and what you think you'd like to borrow

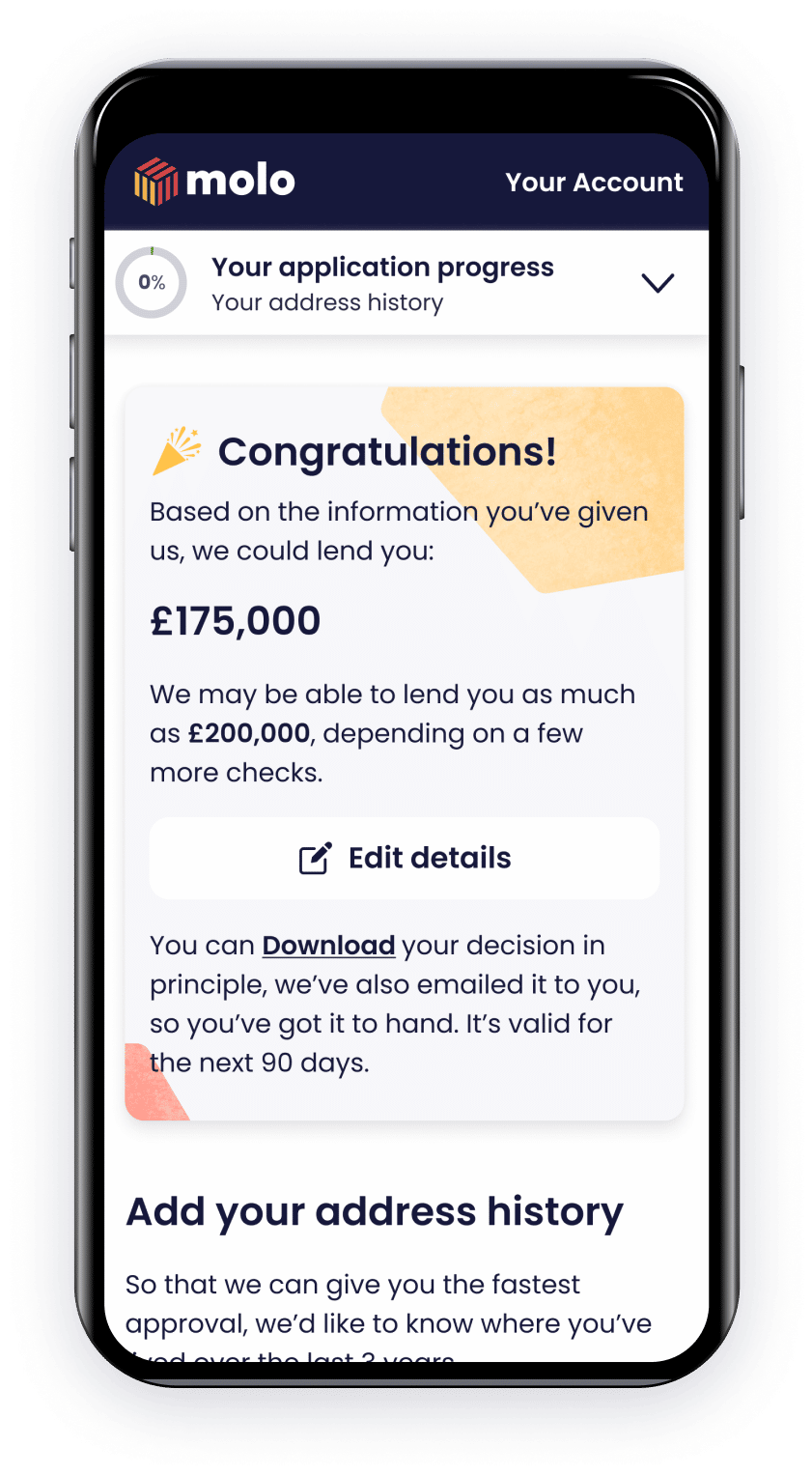

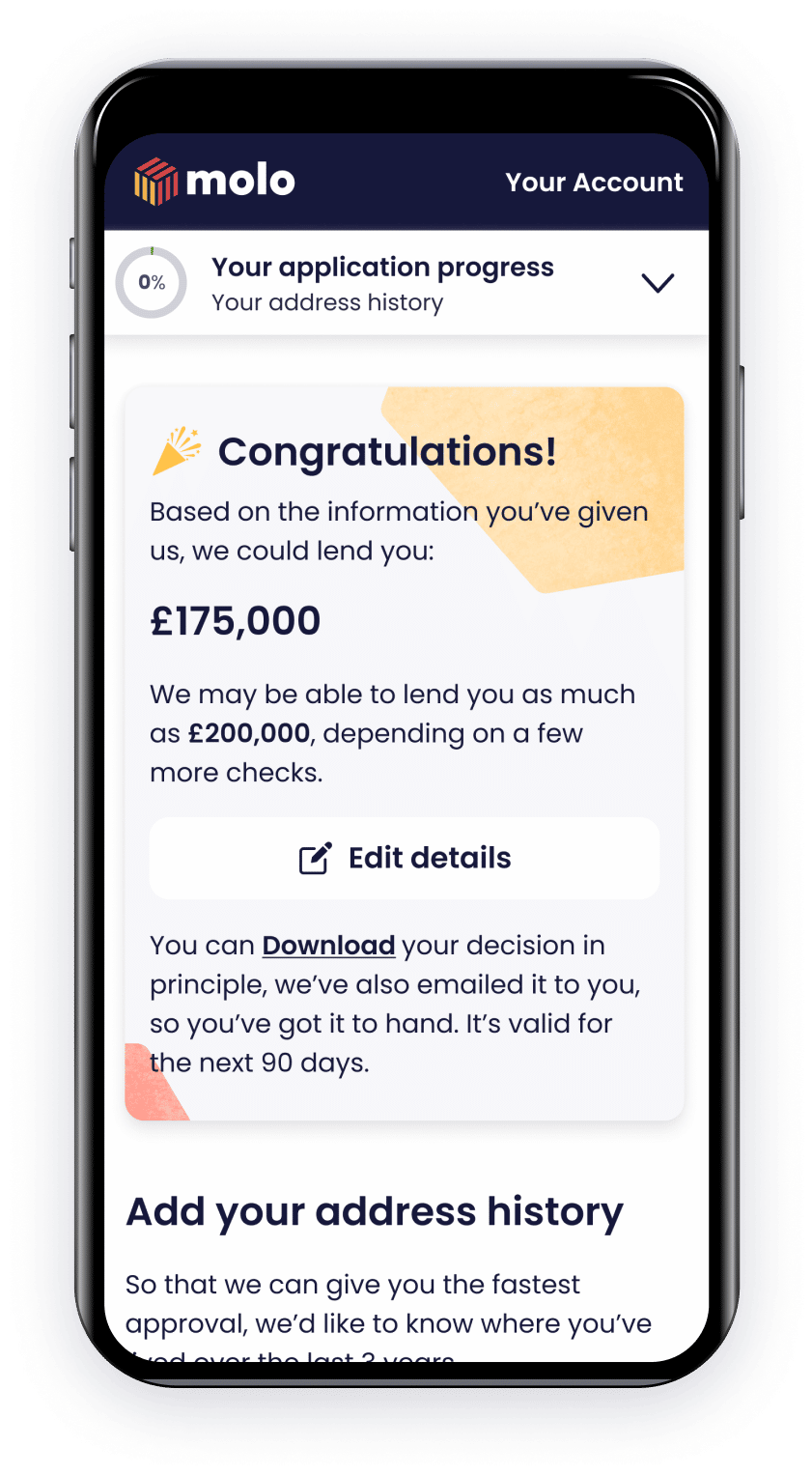

Mortgage in Principle

Mortgage in Principle

We'll let you know whether we can lend to you and how much you can borrow

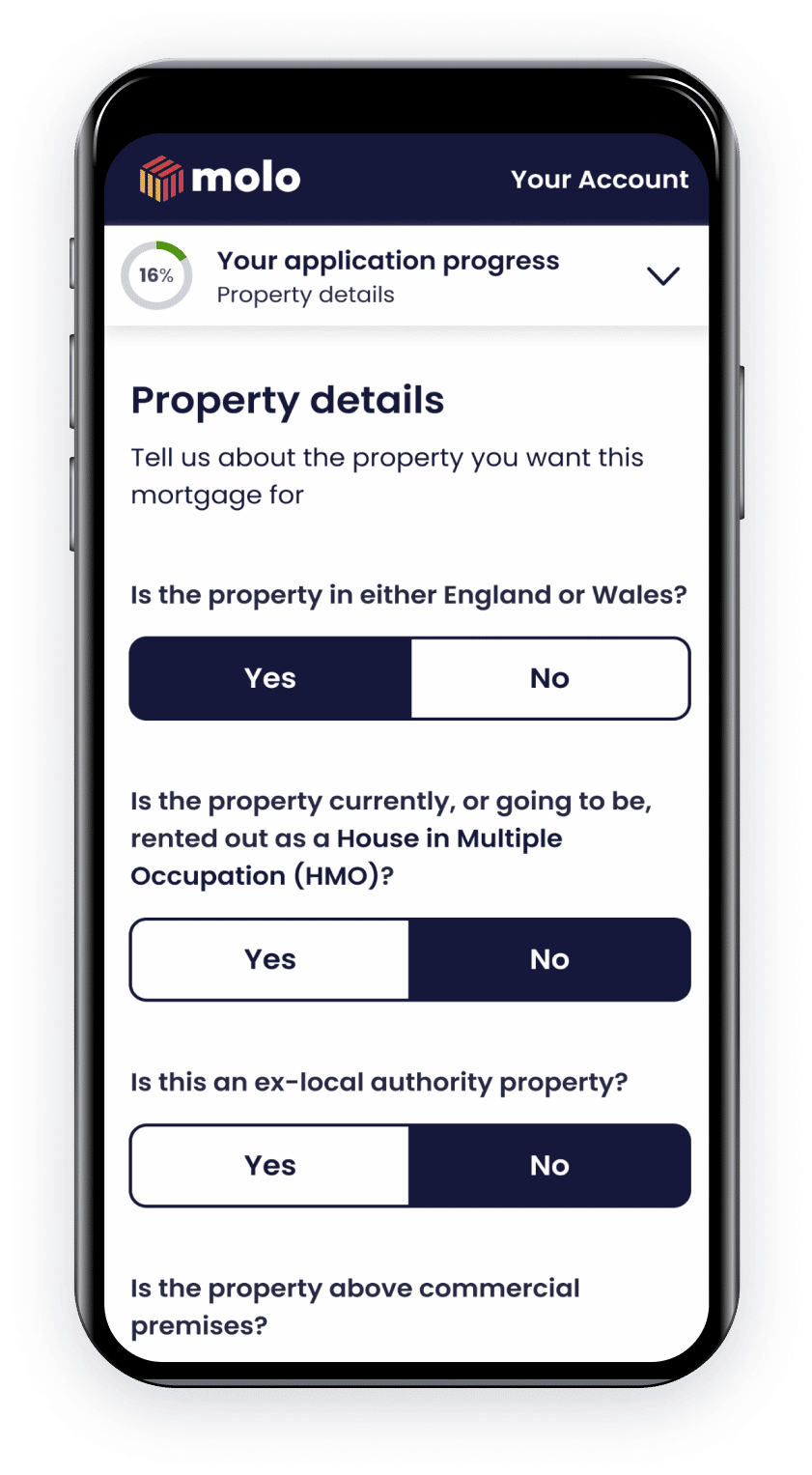

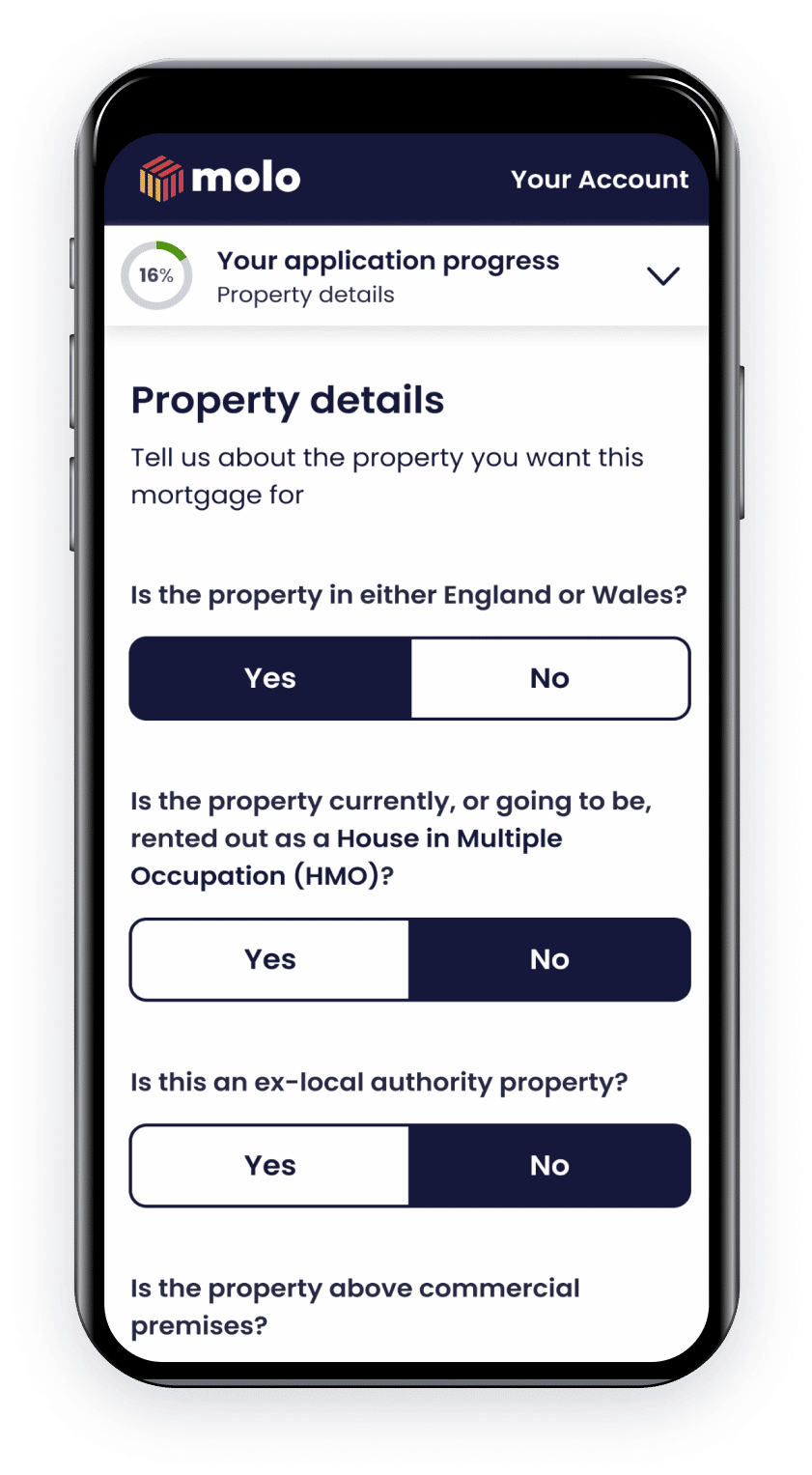

Property check

Property check

Tell us a bit about the property you'd like to buy

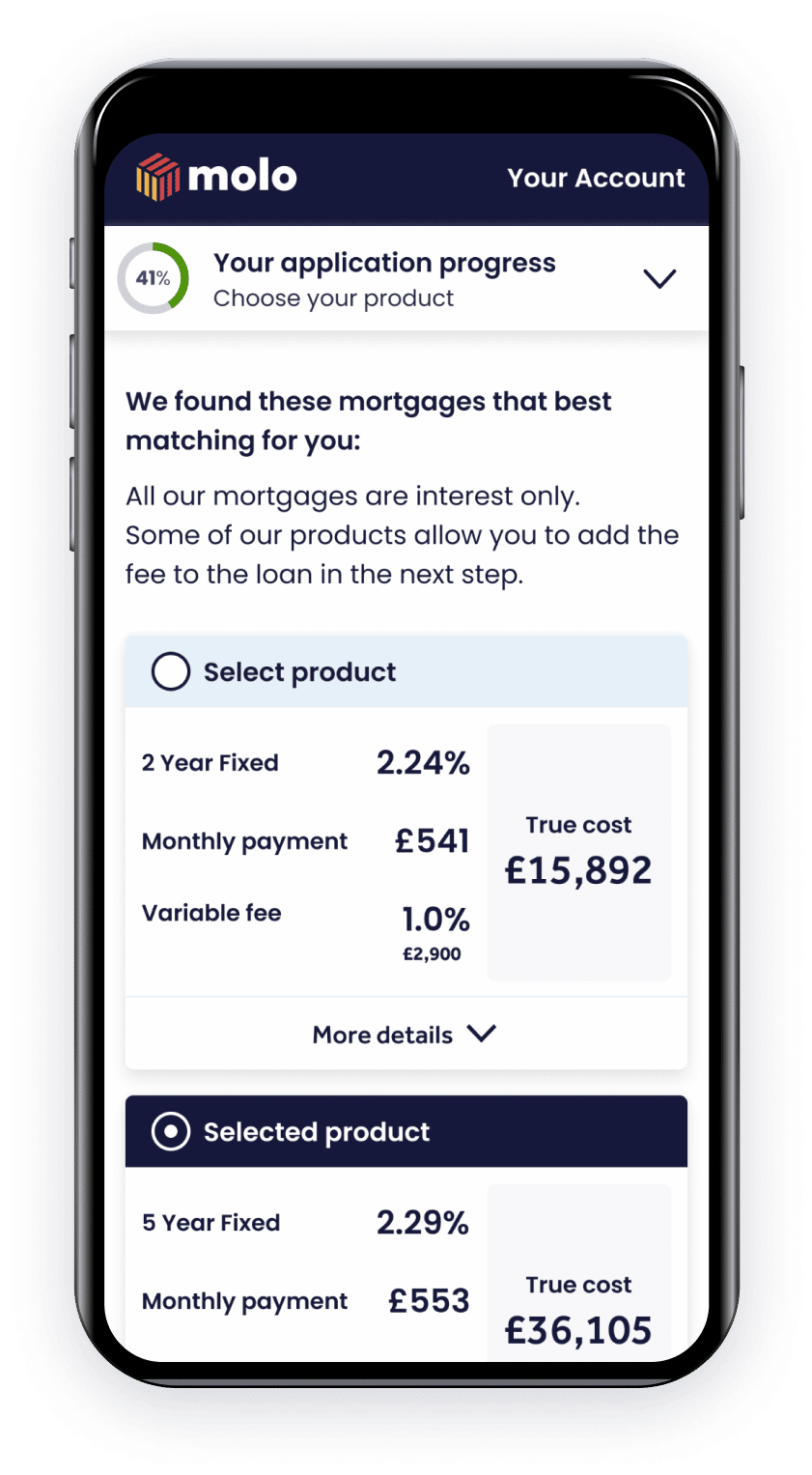

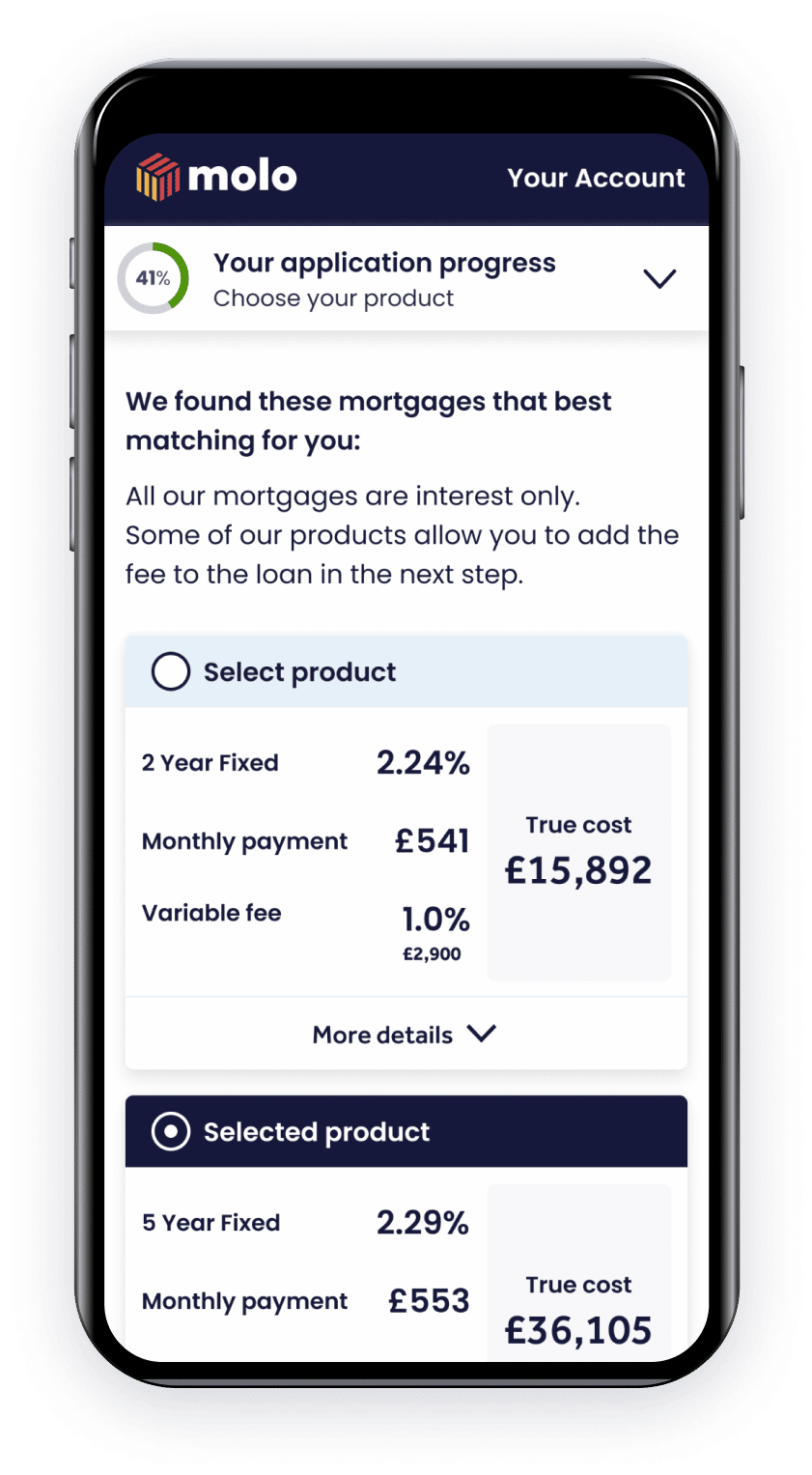

Choose your mortgage

Choose your mortgage

Select the mortgage that's right for you

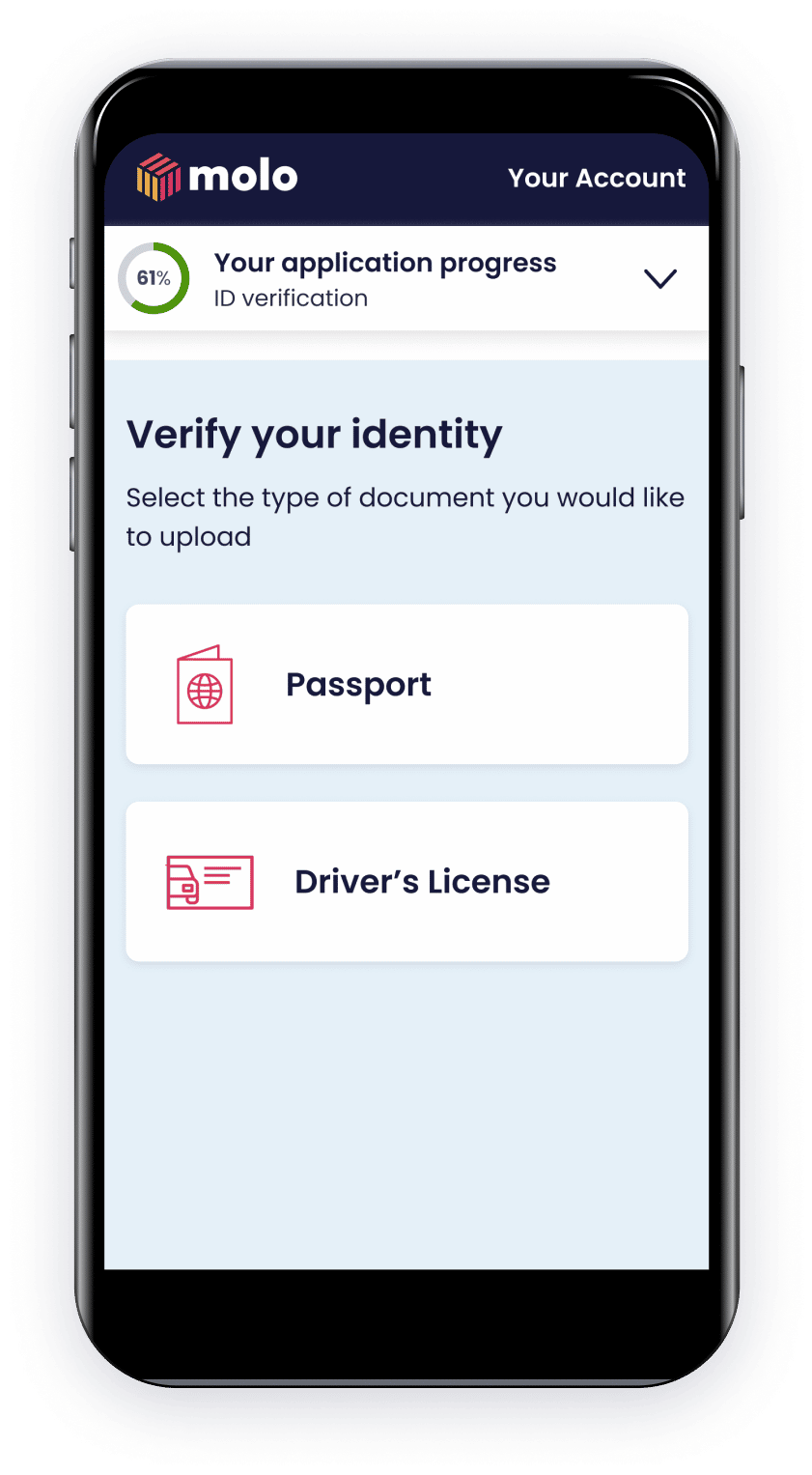

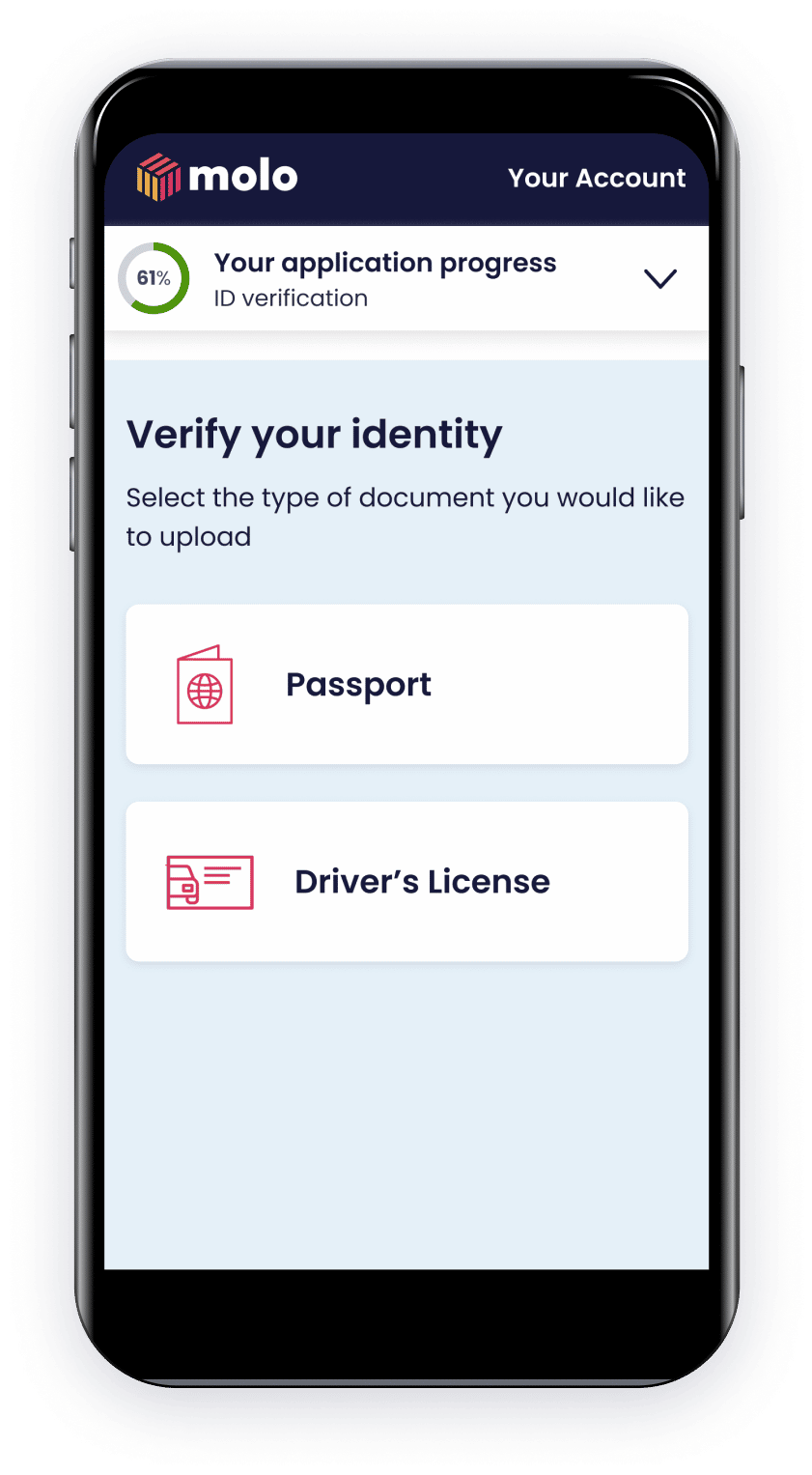

ID verification

ID verification

Upload your ID and take a selfie so we can check you're you

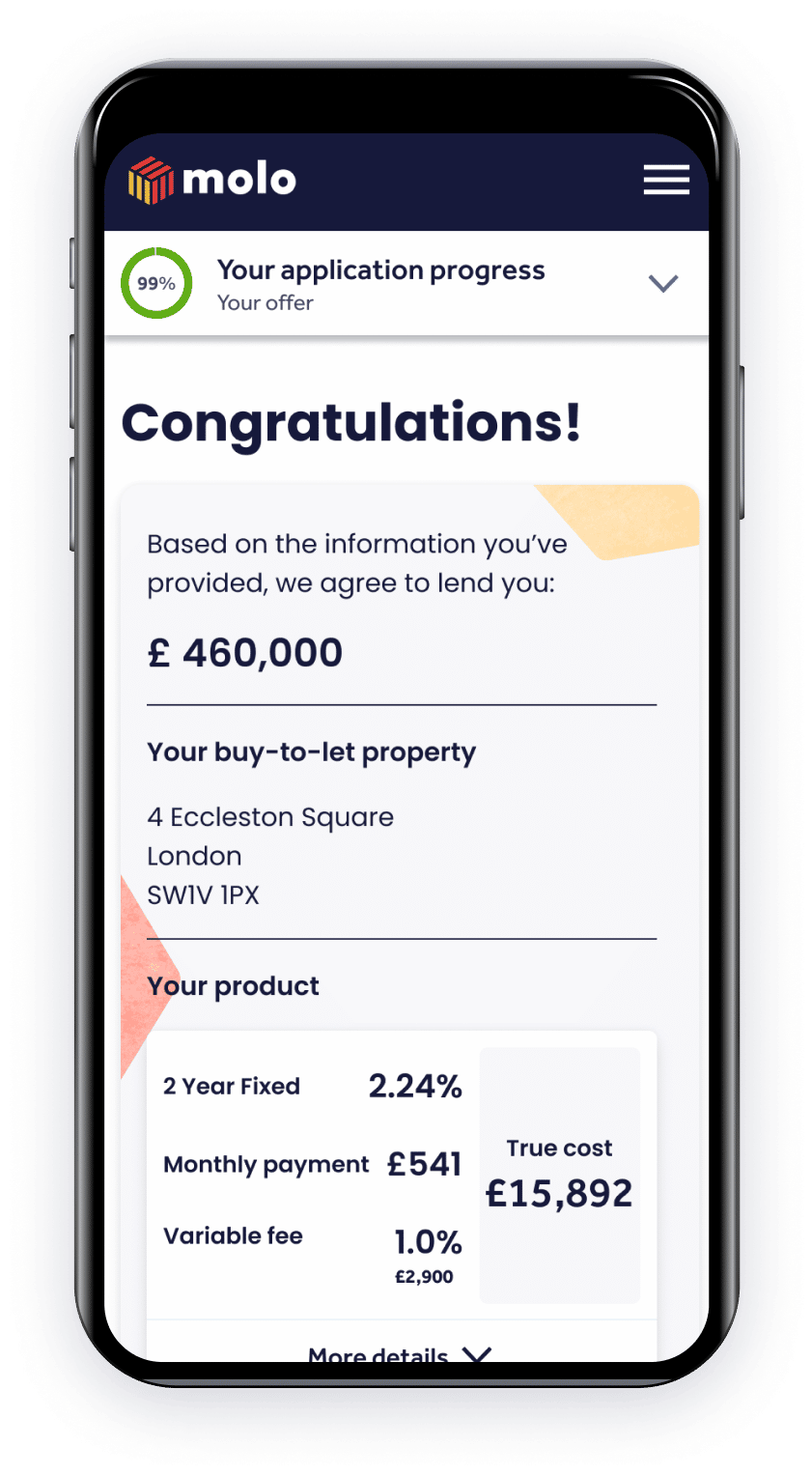

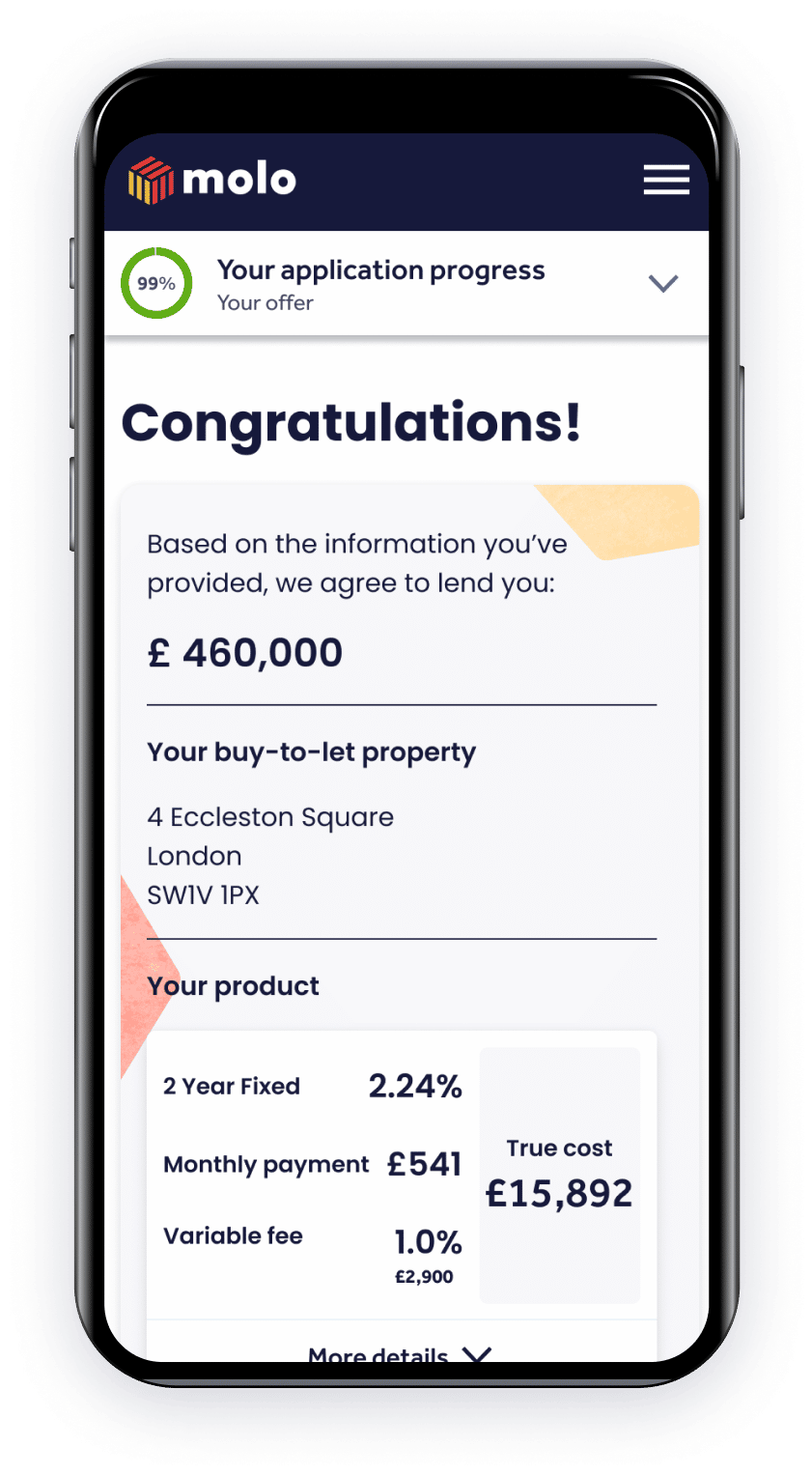

Mortgage offer

Mortgage offer

If you and your chosen property meet our lending criteria, we'll agree your mortgage offer

Check your eligibility

Answer a few questions about you and what you think you'd like to borrow

Mortgage in Principle

We'll let you know whether we can lend to you and how much you can borrow

Property check

Tell us a bit about the property you'd like to buy

Choose your mortgage

Select the mortgage that's right for you

ID verification

Upload your ID and take a selfie so we can check you're you

Mortgage offer

If you and your chosen property meet our lending criteria, we'll agree your mortgage offer

Hear what people are saying about Molo

We make it easier for people to buy a house with an online mortgage loan

" Have been dealing with Molo for a while now and they're a great lender with an easy to use system. Would definitely recommend giving them a go "

See more Trustpilot reviews

Jamie

United Kingdom

See what other customers say

Learn more about remortgages

There are several reasons when you can remortgage:

- To reduce your monthly payments

- To pay off a larger amount and reduce the remaining term

- To borrow more to fund renovations, etc

Usually, you’ll want to start the remortgage process around three months before the end of your current deal. This should allow more than enough time to complete the process before lapsing onto the lender’s (usually) more expensive Standard Variable Rate.

There isn’t a limit to the number of times you can remortgage. However, the timing is important to avoid any penalty fees.

Remortgaging is usually done at the end of your initial period (usually 2 or 5 years) to avoid lapsing onto a lender’s higher Standard Variable Rate. So you might remortgage 12 times over a typical 25 year period.

If you remortgage during a fixed term deal, you might have to pay a penalty called an early exit fee. This can be expensive and should only be considered when absolutely necessary.

Yes, you can. There are certain circumstances when you might want to bite the bullet and pay an early exit fee to remortgage in the middle of a fixed rate deal.

- To immediately sell a property and pay off the mortgage in full

- To take advantage of a much better mortgage deal

- To release equity in your home at short notice, etc

In all situations, it’s important to consider what the exit fee will cost as it’s usually a percentage of the remaining loan amount (which can work out to be a lot!) If in doubt, seek advice from an independent financial adviser.

If you have a fixed term mortgage, you’ll need to wait until the end of its initial term (usually 2 or 5 years) to avoid paying a penalty. The remortgage process can begin several months beforehand, but you’ll only be able to switch to the new deal once your current one has finished.

You can still remortgage during the initial period if you wish, but you might need to pay an expensive early exit fee to do so.

If you don’t have a fixed term mortgage (a variable rate, for example) then you should be able to remortgage at any time without penalty.

Get a mortgage with Molo in minutes

Rated 4.8 on Trustpilot

24/7 online access

100% paperless

Mortgage in Principle in 2 min

Your home may be repossessed if you don’t keep up repayments on your mortgage.

Buy to let

Mortgage help

About Molo

Resources

Get mortgage news straight to your inbox

Molo Tech Ltd is registered in England and Wales no. 10510180. Registered office: Industrious, Office 405, 4th Floor, 70 St. Mary Axe, EC3A 8BE. Molo Tech Ltd is a wholly owned subsidiary company of ColCap Financial UK Ltd that is registered in England and Wales no. 14127877.