Savings Booster Account

Reduce the interest you pay on your mortgage by paying sums into a linked overpayments account.

Benefit from your savings

Save money

Deposit funds into your linked account and lower your monthly payments

Smart rate

Interest is calculated daily, so you benefit from deposits immediately

True flexibility

Borrow-back funds at any time or pay directly to others

Learn more about how you can lower your monthly mortgage payments

In this guide:

- What is a Savings Booster?

- How does the Savings Booster work?

- Does Savings Booster reduce my monthly repayment?

- Savings Booster vs overpayment

- What are the benefits of using a Savings Booster?

- What is a borrow-back facility?

- How does borrow-back work?

- What happens if I borrow-back?

- Can I withdraw money from my mortgage?

- Is the mortgage balance going up with borrow-back?

- Does the borrow-back facility apply to any mortgage?

The Savings Booster is available on all new Molo buy to let mortgages, and allows you to have flexibility and the ability to reduce your monthly payments. You can do this by depositing funds into your Savings Booster – an overpayments reserve account linked to your mortgage. Money paid into your Savings Booster will not reduce your mortgage balance but will reduce the amount of interest you pay.

This means that while you will not earn interest on the funds in the Savings Booster, your monthly mortgage repayments will be cheaper because of the interest saving.

Savings booster works very similar to offset mortgages

How does the Savings Booster work?

A Savings Booster is actually quite simple: Imagine you have a mortgage of £300,000 and you transfer £30,000 into your linked Savings Booster. You would only pay interest on £270,000. Your monthly payment is reduced accordingly, after the Savings Booster fee is charged. This fee is charged at 50% of the interest saved.

From the example above:

Does Savings Booster reduce my monthly repayment?

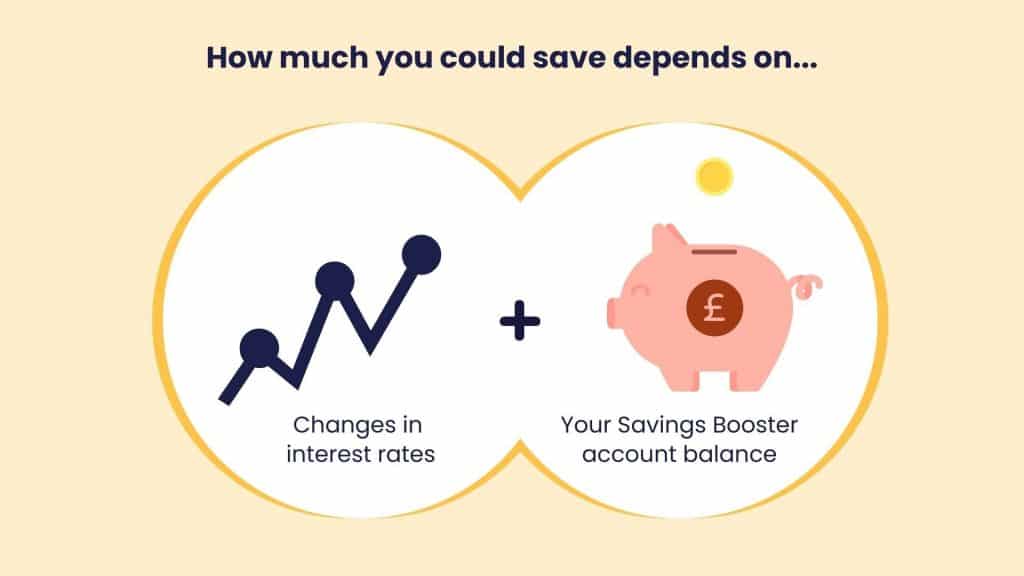

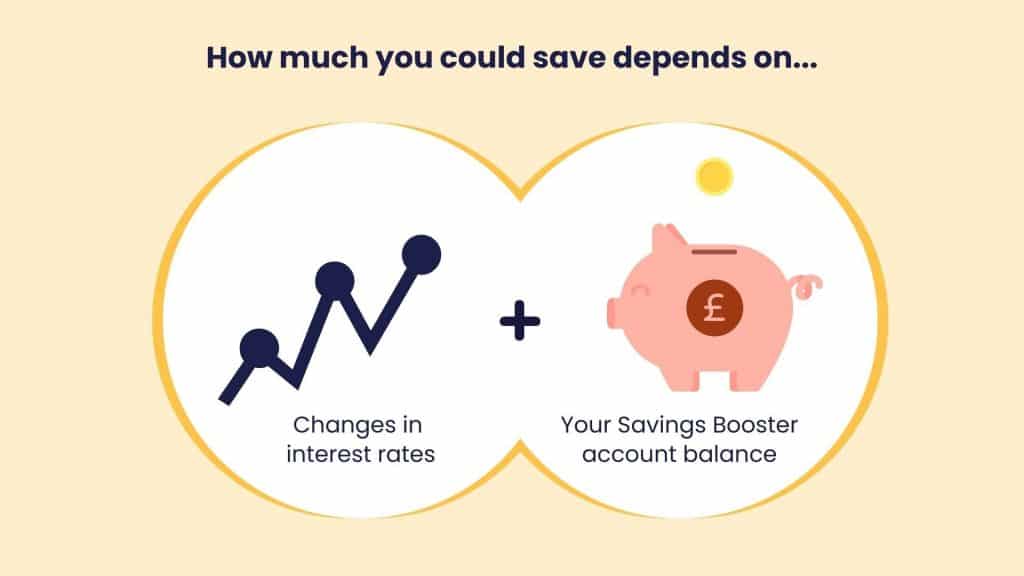

- We will take any extra money you transfer to your Savings Booster into account when we calculate your monthly mortgage payment so you can reduce your mortgage payment by depositing money into it.

- Interest is calculated daily, so we calculate your interest saving each day and apply it to your next monthly payment.

Savings Booster vs overpayment

Savings Booster is an alternative way to make partial repayments of your mortgage without charge. If it is a fixed rate product, you can only repay up to 10% of the loan amount each year during the fixed rate period but otherwise you can use the Savings Booster to make partial repayments of your mortgage by any amount at any time.

- Savings Booster has a fee charged on the interest saved – overpayment does not

- Savings Booster funds can be borrowed-back but an overpayment cannot

- There is a 10% restriction applying on fixed rate products on making partial repayments from the Savings Booster during the initial fixed rate period. And Early Repayment Charges (ERCs) apply to full repayment during the initial fixed period.

Transferring money to your Savings Booster will allow you to reduce the amount of interest you pay. This is not the same as an overpayment. While the Savings Booster is not an offset mortgage, it works in a similar way.

To determine which approach is a better use of your money, you may need to speak with a Financial Advisor.

offset mortgages don’t charge a fee on the mortgage

What are the benefits of using a Savings Booster?

A Savings Booster account may be a good idea for you, but if you are unsure you can speak with a Financial Advisor

Pros:

- You can reduce your monthly payments by transferring money to your Savings Booster

- You can request to borrow-back from the funds you have transferred to your Savings Booster at any point

- These mortgages may be tax-efficient if you’re a higher or additional-rate taxpayer.

Cons:

- You will not earn interest on any funds held in the Savings Booster

- Depending on interest rates/products, you may be better off using your savings to pay down the mortgage balance itself. If you are unclear on this, speak with a Financial Advisor.

offset mortgages give full access to your funds like an offset account would.

What is a borrow-back facility?

Once you have funds in the “Savings Booster” account, you can take some or all of these funds out using a drawdown facility. It allows you, for example, to pay off your mortgage earlier; to underpay your mortgage for a period; and to request to borrow-back your overpayments.Once the funds are removed from the Savings Booster, the payable interest is recalculated (interest is calculated daily).

How does borrow-back work?

With borrow-back, you can request that the funds go to your account or are paid to a third party, for example to pay any bills associated with your BTL property. You can use the sums built up in the Savings Booster to make some or all of your contractual monthly payments for an agreed period. You can also use the Savings Booster to repay your mortgage in full or in part. Note that this will reduce the amount you have available to borrow-back, as the borrow-back facility applies only to your Savings Booster and restrictions or charges may apply depending on the product. It’s also important to remember, if you remove funds from the Savings Booster in this way, the interest saving is affected.

What happens if I borrow-back?

If you make a request to withdraw funds from your Savings Booster, your interest will be recalculated and your monthly payment will increase in line.

Can I withdraw money from my mortgage?

No, you can’t withdraw money from your mortgage balance, but you can request to borrow-back from your Savings Booster. The Savings Booster and borrow-back feature sit alongside but are separate from your mortgage.

Is the mortgage balance going up with borrow-back?

Once a drawdown is actioned, your interest payment will increase – by withdrawing funds from the balance of your Savings Booster, you will increase the amount that interest will be charged on and your monthly payment will increase as a result. The interest rate itself will not change.

Does the borrow-back facility apply to any mortgage?

The drawdown facility is available for Molo customers that have an active Savings Booster account. The Savings Booster and borrow-back facilities are available on all Molo buy to let mortgages.

get an offset mortgage online at any time with Molo

Author: Sim Singh , 2022

As our Mortgage Product Manager, Sim believes in shaping the market, not following other lenders. He is our expert on the mortgage market and shares his insight on buying large HMOs to incorporating your portfolio, and everything else in between.