It’s been a whole 10 months since Molo first launched its mortgage offer to the UK market (we can’t quite believe it!), so, I thought now would be a great time to update you on our journey so far and our plans for the future.

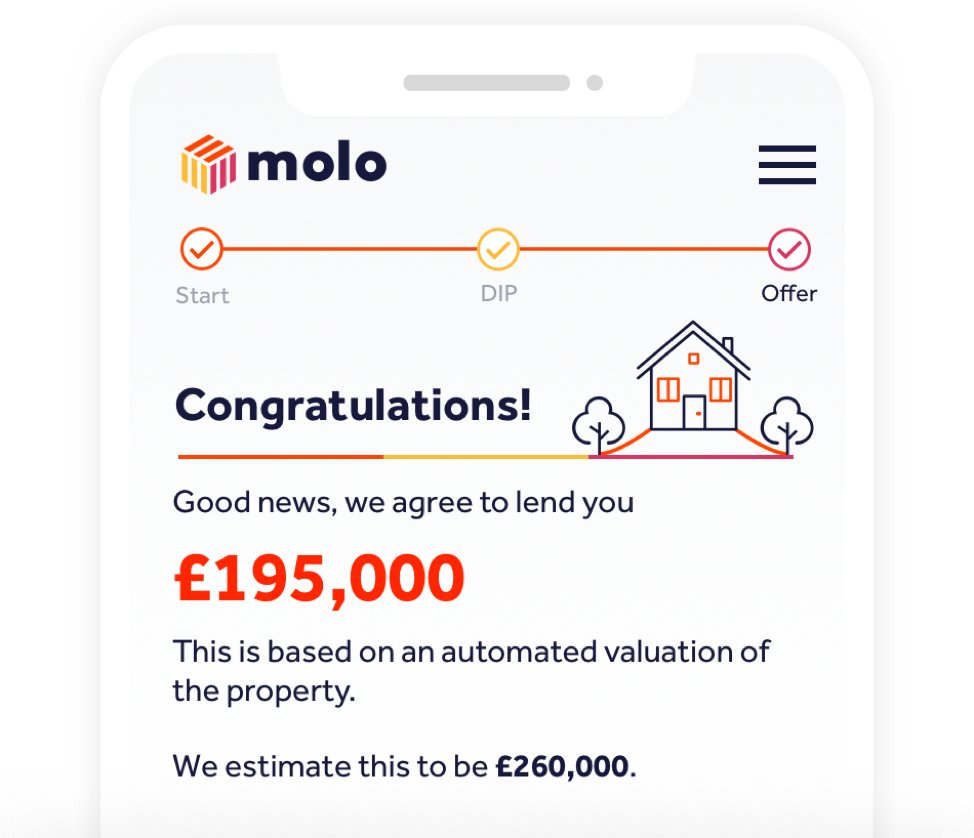

I started Molo with one clear goal: to develop a modern mortgage proposition to give the people of the UK what they’ve long deserved – the ability to get a mortgage quickly, easily and with complete clarity (how it should be!). To achieve this we leveraged the very best in tech and intelligent data, digitising the entire process to create the UK’s first fully online, fully digital mortgage. We successfully found a never-before-done way to provide customers with quicker decisioning, full transparency, a paperless process and, in time, lower costs.

Since launching our first buy-to-let mortgage range in November 2018, we’ve seen encouraging results with steadily increasing demand for our products and frequent requests for expansion of our services. Overall we’ve received an incredible amount of positive, supportive and constructive feedback which is helping us to make Molo even better (thank you!).

So, what does life at a startup look like after 10 short months? I’d say it involves a lot of hard work, a culture of continuous improvement, and a precision-like approach to providing customers with the best possible experience. And, not forgetting, a bit of fun to add into the Molo mix.

It’s all about you

There is no business without its customers, and frankly, our early adopters have been fantastic. Since launching, we’ve seen week-on-week growth on every key metrics including site traffic, customer enquiries and applications. On average over 5,000 visitors come to our site each week to find out more about Molo, with a high percentage of those making an enquiry – whether that’s to find out more about our brand or ask questions about our mortgages. Thanks to you we’ve achieved an impressive 8.3 Trustpilot rating and are very happy to have received 100% customer service satisfaction. Please keep the feedback coming!

Finding & providing true value

2019 kicked off with the loan value of our applications hitting double-digit millions on a weekly basis, with the total value of our applications surmounting £250m in our first half alone.

Landlords now have the freedom to apply for a buy-to-let mortgage whenever and wherever they want. And such flexibility, coupled with an efficient application process, is helping to drive real change in the way people view the mortgage industry. These numbers tell us there is an appetite from consumers to buck the old, outdated trends of the mortgage industry and embrace a new, smarter way of doing things. Much to our surprise, we even approved and issued a mortgage offer late on Christmas Eve. You might say that Molo and Mr. Claus were working in perfect (and very efficient!) harmony.

Getting techy with it

A company needs to continue to evolve on every level. Stand still, and you’re left behind. Since our launch, we’ve released more than 80 tech updates to improve how people use Molo daily.

Whether it’s adding new product features or improving customer experience, we’re always thinking up new ways to squeeze the most out of the site and make the journey as simple as possible for our customers.

Pushing products even further

We’re extremely happy to have, just last week, extended our Limited Company mortgage range to include multi-director applicants. Importantly, this means multiple applicants will no longer have to co-ordinate diaries or disrupt plans to gather in one place at one time to sign documents or give information. One applicant can complete their part online and then an email is automatically sent to the next. Simple!

This new multi-director mortgage joins Molo’s already impressive line-up including our original buy-to-let mortgage product for individuals and limited company products, with residential mortgages expected to launch in 2020. Watch this space.

Manchester lovin’

Manchester is a buy-to-let hotspot seeing plenty of demand for properties, meaning landlords from all over the UK are looking towards the northern powerhouse with eager eyes. As part of our marketing drive, we’ve spent a considerable amount of time in Manchester, getting a real feel for the area (Manchester we love you!) and understanding how the buy-to-let market operates in the M postcode.

We attended the National Landlord Association in South Manchester for Landlords, where we spoke with many investors to get a better understanding of what they want in a mortgage application process. No prizes for guessing that speed was a key theme.

If you’re looking for more information on Manchester, check out our recent articles: Manchester’s make-up and All aboard the Manchester buy-to-let train. It’s just one of the many exciting cities for buy-to-let investment at the moment, and we’ll be covering more hotspots in the coming months. Stay tuned!

In the press

From tech updates to awards nominations, we’re thrilled to have received plenty of plaudits since Molo’s launch.

In February I personally had the pleasure of speaking with Forbes about the Molo business model, how and why it works, our journey so far and what brought me to this point. I also joined a panel at the Innovate Global Finance Summit in April speaking with fellow CEOs and industry leaders about exciting innovations shaping the world of fintech today. And though not winners this time around, we were thrilled to be nominated in the Best Buy-to-Let Lender category in the What Mortgage Awards this July (not bad for having only been in the public domain for only nine months!).

The future and beyond

We’re already making great waves in the world of buy-to-let mortgages and are planning to introduce residential in the not too distant future so that we’re able to offer even more people an easy, fully online, pain-free mortgage.

It’s been such a positive launch for Molo, and we’re even more encouraged by the response from our brilliant customers. There’s plenty more in store for the rest of 2019 as we look to further change the way people get a mortgage, for good.

Stay up to date with the Molo journey and follow us on Twitter.